Today’s legal industry is anything but static. The field is constantly in motion—with increasing workloads, more stringent client demands, and heightened competition creating both hurdles and opportunities.

For small and midsized law firms, confronting these dynamics is not just necessary—it’s an invitation to redefine the rules of the game.

PracticePanther’s 2024 Small & Midsized Law Firm Report serves as your strategic playbook and nuanced lens into the pivotal developments that are reshaping the industry. Armed with data-driven insights and in-depth analysis, you’ll be uniquely positioned to seize opportunities and turn challenges into stepping stones for growth. From refining your hiring processes to optimizing budget planning, our report lays down the path for small and midsized law firms to generate greater returns in the new year.

Small and midsized firms are turning evolving market dynamics into stepping stones for growth.

Running a successful small and midsized law firm has always demanded determination and resilience. But as the legal market continues rapidly changing, adaptability and efficiency are sharply rising among the list of essential characteristics. With increasing competition from both large and niche firms, the weight of client demands, and the uphill battle in recruiting top-notch talent, many firm leaders find themselves at a crossroads. As they invest more time and energy into their practices, they must now make pivotal choices to avoid an emerging discrepancy between their efforts and their actual cash returns.

Our 2024 Small & Midsized Law Firm Report delves into this increasingly common and challenging dynamic where working harder doesn’t always equate to making more money. Yet even in the face of this tough reality, small and midsized law firms are making strategic plays to achieve a brighter and more profitable 2024.

In addition, although economic uncertainty casts its shadow on the coming year, one sentiment stands strong among the legal community: optimism. This confidence is more than wishful thinking; it’s rooted in smart investments and proactive decisions that firms are making to reverse the tides of slowing cash flow and hard-fought growth. They are reimagining their approach, demonstrating confidence, and positioning themselves to not only adapt, but lead.

If you are a legal professional aiming to effectively adapt in a changing market, this industry report is your roadmap. We lay out actionable insights to optimize efficiency, stand toe-to-toe with larger competitors, and craft a vision for a prosperous year. By tapping into firsthand experiences from the frontlines—where your peers have innovated and thrived—you can carve out your own place in this competitive and rapidly changing field.

Firm leaders are making pivotal choices to ensure rising workloads are translating into greater returns.

Data Sources

We combined multiple data sources and research methodologies to provide unparalleled insight into the legal sector. This analysis focuses on capturing the most accurate picture of law firms in today’s unpredictable economic conditions. Data collection occurred between July 2023 and August 2023, offering a timely snapshot of the industry.

Comprehensive Survey Focused on Key Metrics

Our survey includes responses from an expansive group of legal professionals from small and midsized law firms. We asked respondents about an array of topics, including hiring trends, budgetary projections, competitive positioning, operational efficiencies, and much more. This unique pool of information provides a window into the pulse of the industry and serves as a central component of our comprehensive analysis.

PracticePanther Data

We’ve analyzed aggregated and anonymized data from tens of thousands of law firms and legal professionals. This data delves into the core performance metrics that underlie the day-to-day and strategic decisions law firms make. Complementing our comprehensive survey, these insights add another layer of depth to our understanding of the industry’s obstacles and opportunities.

Part 1: Despite Macroeconomic Changes, Law Firm Budgets Suggest Optimism

As we examine the challenges and opportunities facing law firms today, it’s essential to also consider the larger economic factors at play. 2023 has been a challenging year for many sectors, with layoffs becoming a widespread trend.1 Such a backdrop makes it even more vital for law firms to be strategic in their planning.

Businesses across the board—and law firms are no exception—unsurprisingly take precautionary steps when facing potential economic downturns. These steps often include re-evaluating financial goals, reducing spending in various areas, and even downsizing staff to conserve resources.

But here’s where law firms stand out: they’re maintaining a positive view of their firm’s near and medium-term outlook, demonstrated by persistent investment in key budgetary categories.

In fact, most firms plan to either maintain or increase their budgets for the coming year, aligning with broader growth trends for the larger legal market. Recent data suggests that the global Legal Services sector is expected to grow at an average rate of 5.18% per year for the next six years.2 This projected growth rate underscores the optimism we see in firm budget plans, showing that even amid challenges, there are opportunities for expansion and success.

For Part 1 of this 2024 Small & Midsized Law Firm Report, we’ll explore the areas where these firms are continuing to invest, even as economic conditions fluctuate. Through this lens, we examine the various approaches firms are taking to position themselves for success in both the near and long-term.

Most firms plan to either maintain or increase their budgets for the coming year, aligning with broader growth trends for the larger legal market.

Even With Looming Economic Uncertainty, Law Firms Exhibit Fiscal Confidence

Economic indicators across the United States have displayed considerable variability from 2022 into 2023, with early signs in 2023 pointing toward a potential economic deceleration and possible recession.3 Leading economists and government institutions have forecasted slower growth, and recent actions by the Federal Reserve—including 11 interest rate hikes from March 2022 to July 20234—have done little to alleviate these concerns.

Contrary to this cautious atmosphere, recent data from mid-2023 suggests a more nuanced story. While the forecasted real GDP growth hovers at a modest 0.4% for the second half of the year, a brighter outlook emerges for 2024 and 2025, with expected growth rates of 1.5% and 2.4%, respectively.5 Encouragingly, unemployment rates appear to be falling as 2023 winds down,6 and consumer spending ticked up by $83.6 billion or 0.4% in August.7 And after inflation reached a brutal peak of 9.1% in 2022, rates have moderated to 3.7% as of August 2023.8 Yet even with these signs of stabilization, the prevailing mood remains one of unease.

This unease may stem from the mass layoffs at major companies like Google,9 Meta, Microsoft, Disney, T-Mobile, and many more,10 as well as the historic failure of two significant U.S. banks.11 In light of these complex developments throughout the year, what does this mean for the legal sector?

Interestingly, the small and midsized law firm sector appears to be taking a different path, as laid out in the coming pages of this report. They seem to be adopting a growth mindset rather than hunkering down for an economic storm. Many of these firms are actually investing more in their practices instead of scaling back.

Small and midsized law firms are finding opportunities for growth, investing in their firms rather than scaling back.

Why is this happening? These firms might be seeing new opportunities that larger entities, burdened by their size and complexity, cannot pivot quickly enough to capitalize on. Another plausible explanation is an often-overlooked factor: the legal industry is generally more insulated from economic downturns than other sectors. For example, certain practice areas—like family and criminal law—are generally recession-resilient12 and can even experience growth during economic downturns. Legal services, unlike many other sectors, tend to benefit from relatively inelastic demand, spelling continued opportunity for law firms whose value does not simply disappear in tough economic conditions.

So, while the jury is still out on the overall economy’s trajectory, small and midsized law firms seem to be finding a niche of potential growth, choosing to invest in their future rather than retreating into caution. It’s a compelling separation that highlights the agility and confidence often present in small and midsized operations.

In light of all this, let’s zoom in further on the spending behavior of small and midsized law firms, which tells its own unique story.

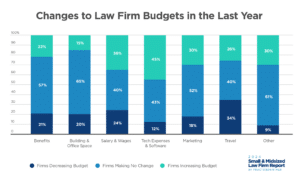

Over 75% of Law Firms Are Increasing or Maintaining Budgets in Most Major Categories

While many businesses are tightening their purse strings, we are seeing very different behavior from law firms. Less than a quarter of these firms have cut their budgets in 2023. Most of them have actually maintained their existing budgets or even increased their investments across certain categories.

When examining spending in key areas, over half of law firms are sticking to their previous year’s allocations. The pattern suggests not just stability, but a calculated confidence.

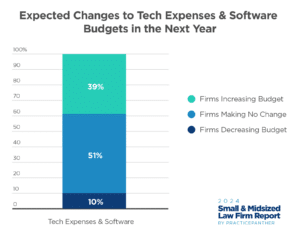

Some categories, like Technology Expenses & Software and Salaries & Wages, are seeing increases in budget. These trends are far from coincidental; they align with industry-wide shifts. For example, the rise in technology spending mirrors the growing importance of digital solutions in legal work, enhancing efficiency and client satisfaction. Likewise, in a job market that’s more competitive than ever, retaining top talent is crucial.

As for marketing, the data suggests that law firms are not shying away from the fight for new business. They know that a strong brand and a robust client pipeline are invaluable assets, especially when times are tough.

These investment patterns reflect a deeper understanding of creating value and assuring long-term financial health, even when the economic outlook is uncertain. As we dig into the specifics of these budgetary choices, we’ll uncover the individual strategies that contribute to this overall financial strength.

Continued investment in major spend categories reflects a sense among small and midsized firms of not just stability, but calculated confidence.

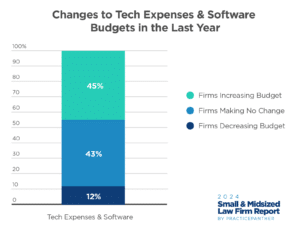

Technology Expenses & Software Budgets

The notion that “technology matters” has transformed from an emerging idea to an operational cornerstone. Adopting innovative technology is now a strategic choice that defines how these firms drive business, serve clients, and manage processes.

As more law firms transition to remote work arrangements, the implications go beyond where lawyers are physically located. This change has fundamentally redefined the practice of law itself, making technology more critical than ever. Recognizing this shift, the American Bar Association’s Model Rules of Professional Conduct now advocate that lawyers need a nuanced understanding of technology. Compliance is a key reason for this new standard, but it also establishes the benchmark for what effective legal practice should be in our increasingly digital age.13

Small and midsized law firms are gearing their technology investments in 2023 toward:

- Achieving Long-Term Efficiency: Not just any software platform will do. Firms are integrating comprehensive solutions that streamline operations from client intake to document management, significantly reducing the time spent on non-billable tasks.

- Enhancing Client Services: Gone are the days when face-to-face meetings were the gold standard of client interaction. With clients demanding more flexibility and quicker responses, firms are offering alternative methods for consultations and follow-ups, like video conferencing, text messaging, and secure client portals.

- Improving Firm Finances: Amid economic fluctuations, firms are leaning into technology that allows them to meticulously track billable hours and manage invoicing. And by providing secure and prompt payment options, these software solutions are crucial to maintaining healthy cash flow.

Adopting innovative technology is now a strategic choice that defines how firms drive business, serve clients, and manage processes.

In fact, 45% of law firms and 50% of solo practitioners have upped their spending on software and technology over the last year. While this seems to be the case across the legal field, firms in certain practice areas are investing in technology at a greater pace:

- 75% of family law firms increased technology expenses and software subscriptions. With cases often requiring a barrage of personal documents, a secure and efficient system for storing and sharing these files is invaluable. Moreover, technological solutions offer the flexibility that families going through legal issues desperately need. Using platforms for case management and scheduling makes the collaboration between parties more efficient, alleviating some of the stress and time pressure often experienced in family law cases.

- 83% of insurance defense firms increased technology expenses and software subscriptions. With insurers demanding more work without an increase in rates, these firms must look for efficiencies elsewhere. Instead of settling for off-the-shelf software, many are turning to technologies that can be customized to meet their specific billing needs, making it easier to manage the unique challenges they face.

Far from a passing trend, this technological pivot is shaping the future of the legal sector. It serves as a commitment to progress, efficiency, and a focus on clients—values that we expect will deepen in the future.

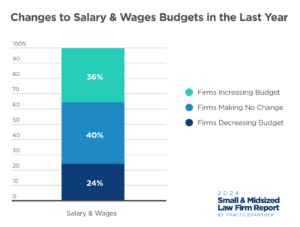

Salaries & Wages Budgets

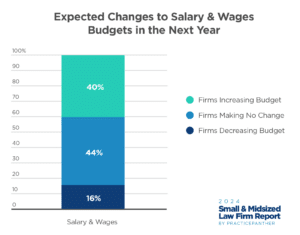

While economic volatility swirls, law firms are holding their ground, particularly in staffing budgets. Remarkably, 75% of such firms have maintained or even bumped up their salary budgets.

This determination to invest in talent becomes even more significant when viewed in the context of the current legal market. For instance, salary hikes in large firms are pressuring small and midsized practices to keep up.14 Essentially, the “talent wars” among major players are having a ripple effect, raising the stakes for small and midsized firms in a competitive market. This pressure places these firms in a bind; escalating salary expectations are making it increasingly difficult to grow their staff numbers, even as they commit to greater yearly spending on salaries.

The talent pool itself presents another challenge. Legal recruitment agencies have made it clear that firms are hard-pressed to find mid-level associates with rigorous training, as many newer associates have only known the remote work setup due to the pandemic.15 This issue has a two-fold impact: first, these new mid-levels may not have the full range of training typically expected. Second, they are more likely to demand remote work, influencing both the types of candidates available and the kinds of perks small and midsized firms must offer to attract them.

Yet, despite these pressures, small and midsized firms aren’t shying away from competing for high-performing associates. The statistics speak for themselves: the median first-year associate salary rose 29.2%, from $120,000 in 2021 to $155,000 in 2023.16 This dynamic also showcases how other factors like inflation and macroeconomic trends push these firms to expand their budgets when it comes to hiring and retaining talent.

Although we delve deeper into the complexities of hiring in Part 2 of this report, it is crucial to understand that these elements are driving firms to make calculated investments in their staff. The upward trend in salaries, coupled with various market pressures, signals that spending more on talent is necessary for small and midsized firms to stay competitive.

Marketing Budgets

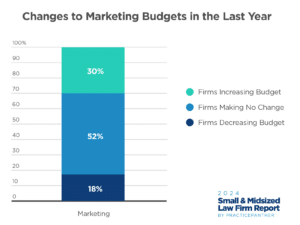

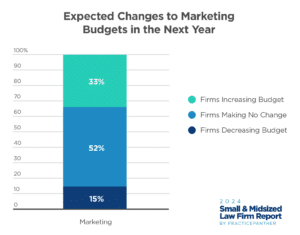

Rather than cutting corners, 52% of firms are maintaining their current marketing budgets, and an impressive 30% are opting to increase their financial commitments.

This strong investment trend aligns with broader legal marketing trends. With 94% of law firms maintaining an online presence via websites—up from 86% in 201917—it’s evident that law firms are recognizing and doubling down on the importance of a strong digital footprint.

Firms are investing significant resources into diverse digital channels, from search engine optimization (SEO) and social media marketing to website development and paid advertising. For a small and midsized law firm, financial commitments for activities like SEO can vary from $7,500 to $25,000, and for paid advertising, costs can be more than double that range.18

For firms that have yet to build a strong online identity, the urgency to invest in digital marketing is even greater. These firms often find themselves in a catch-up mode, needing to invest heavily in both marketing activities themselves and digital marketing infrastructure, from social media management to brand awareness online.

To be competitive, these firms must invest wisely and generously in digital marketing avenues. As they prepare for the upcoming year, many firms are showing a willingness to put their money where their strategy is and prioritize marketing as a primary pillar of success.

Law Firms Will Continue Doubling Down on Technology, Talent, and Marketing

Historical budgetary data provides an insightful snapshot, but what are small and midsized law firms doing to gear up for 2024 as near term economic uncertainty looms? The goal is clear: to invest in their practices’ most valuable assets—talent, technology, and client acquisition—for a sustainable ROI.

Adopting New Technology

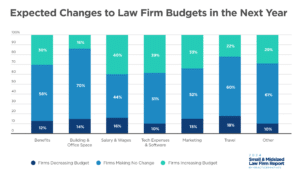

A striking 90% of firms plan to increase or maintain their technology budgets in the upcoming year. This data indicates a clear consensus: technology isn’t a luxury—it’s a necessity for staying ahead.

Solo practitioners, in particular, have expressed a high level of comfort in embracing new technology solutions to help drive their practice forward. Such an attitude sets them apart from their counterparts in large firms. Only one-third of attorneys in large firms share the same sense of ease and confidence when making decisions around the adoption of new technology. The discrepancy is notable and highlights the nimbleness often associated with small and midsized operations.19

Compared to their big law firm counterparts, small and midsized firms often have the flexibility to make quick, impactful changes. Technologies—like instant messaging, remote work systems, and case management software—are becoming fundamental parts of a modern legal practice that can help small and midsized firms stay competitive.

Making Strategic Staffing Choices

As the legal industry marches into the future, the vast majority of firms—84% to be exact—anticipate that their budgets for salaries and wages will either hold steady or increase. This trend reflects a response to various market conditions as well as a larger strategic focus that involves multiple variables.

The ongoing competition for top talent remains a constant pressure for all firms, and the era of remote work has added a layer of complexity to this challenge. Law firms are looking for a new legal professional archetype—one who excels by traditional metrics and can also perform well in decentralized work settings. The types of professionals firms choose to hire now will significantly impact both the internal culture and the firm’s ability to adapt to future opportunities.

Additionally, the varying needs of different practice areas play a pivotal role in these budget decisions. For instance, there is a rise of countercyclical and recession-resilient practice areas, such as bankruptcy law. With increasing numbers of people facing financial hardships due to layoffs during and after the pandemic, these firms are busier than ever. Around 50% of bankruptcy law firms are expecting to expand their staff or realize more staff overtime hours, leading to a corresponding growth in their salaries and wages budget as they prepare to take on growing demand.

In contrast, firms focused on areas more susceptible to economic volatility—such as litigation and dispute resolution—envision a stable, yet static, staffing outlook for the year ahead.20 Unlike their recession-resilient counterparts, these firms have fewer immediate opportunities for growth, which in turn affects their staffing and budgetary strategies.

It’s clear that the battle for talent and the strategic focus on practice area needs are two critical components shaping these financial decisions around salaries and wages. The moves made today in these domains are laying the groundwork for the opportunities that will be available in the days ahead.

Intensifying Marketing Efforts

For 2024, 84% of law firms intend to either sustain or boost their marketing investments. This trend is likely driven by a couple of significant factors. First, countercyclical practice areas are ramping up their marketing spend to capture rising demand. Second, the competitive space is seeing new entrants and alternative service providers reshaping the marketing dynamics, which we’ll explore further in our next section.

The rise in marketing investment offers substantial opportunities, particularly for small and midsized firms. However, it’s not a straightforward path to higher profits. Scaling up caseloads doesn’t automatically mean a proportional increase in revenue, presenting operational challenges that firms need to carefully manage.

As we face the unknowns of 2024, these firms are making deliberate budgetary decisions to focus on what really matters: client satisfaction, revenue stability, and the firm’s long-term durability. These strategies go beyond merely reacting to immediate pressures and lay the foundation for sustainable success.

Firms are making deliberate budgetary decisions to focus on what really matters: client satisfaction, revenue stability, and long-term durability.

Part 2: Even Though Law Firms Are Spending More on Wages and Salaries, They Are Finding Themselves Busier Than Ever

Despite general fiscal optimism, many small and midsized law firms find themselves grappling with a set of internal challenges that are as multifaceted as they are critical. While law firms are allocating more resources to wages and salaries, they are finding their staff workloads rising while the financial return on that work is declining.

The legal sector has changed—clients are demanding more transparency, personalized solutions, ongoing engagement, and more. Consequently, firms aren’t just doing more work to serve their clients; they are doing different kinds of work. The shortage of high-quality talent in the job market exacerbates these challenges, making it more difficult to meet client needs and, in turn, affecting how firms convert effort into realized profits.

In this section, we will dissect these challenges— market competition, evolving client expectations, and the interplay between rising workloads and declining labor-to-cash return.

Staffing at Law Firms Is Stagnant

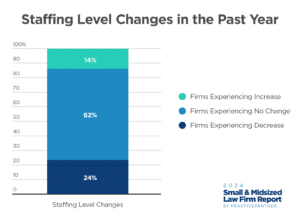

The issue of staffing has reached a tipping point in the legal sector. Data reveals that nearly a quarter of small and midsized law practices experienced a decline in their staff numbers over the past year, while another 62% saw no change.

Part 1 of this report delved into firms’ future staffing budgets, which many plan to either maintain or increase. This strategy often involves offering higher salaries to attract top-notch talent. While one could easily expect this approach to lead to a robust hiring atmosphere, the reality is less straightforward. Increasing salaries are taking up a larger portion of these firms’ budgets, limiting their ability to scale staffing models.

But the financial aspect is just one piece of the puzzle. The larger issue, clouding an already complicated scenario, is the growing difficulty firms are encountering in the recruiting arena.

Firms Are Struggling to Find Quality Talent

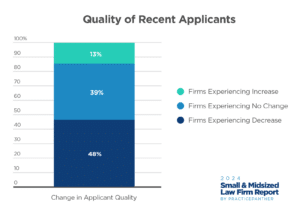

Today’s competitive legal market presents firms with a specific and pressing obstacle: the marked deterioration in the quality of job applicants. 48% of firms report that the caliber of job applicants at their firm has noticeably declined in the past year. Only a mere 13% felt that the quality of applicants at their firm had improved.

This issue presents a significant barrier that makes it difficult for firms to fortify their teams effectively. Plus, firms are facing another layer of challenges in this area: a dwindling pool of seasoned associates and support staff who meet their high standards.

Experienced Associates and Support Staff are Hard to Come By

Firms are grappling with the difficulty of finding seasoned professionals who can immediately contribute to their practice. This challenge becomes more complex when considering concerns about operational stability. Bringing in new team members introduces risk, particularly if they have less experience. The adjustment period and extensive training for these new hires are significant time investments, and these steps are required before the new hires can make any meaningful contributions. Such a phase could potentially compromise the level of service clients have come to expect.

Why is this pool of experienced legal professionals so much smaller? A reasonable explanation is the lasting impact of pandemic-era work conditions. Many young lawyers who entered the field during this time missed out on formative experiences that typically characterize the early years of legal practice. They spent less time in traditional court settings, had fewer hours of in-person training, and enjoyed less interaction with mid- and senior-level attorneys. As these individuals vie for mid-level positions, firms are finding them less prepared than their pre-pandemic counterparts.

Tech-Savvy Support Staff Has Become a Necessity

Legal practices are increasingly dependent on technology, affecting the qualities law firms look for when hiring. Whereas in the past, legal support staff focused on tasks like transcription and scheduling, modern requirements have shifted toward a higher technological proficiency. Today, these professionals must possess skills in digital case management, electronic document organization, client communication through secure online portals, and much more.

Due to the rise of legal software, attorneys have become more self-sufficient in administrative tasks, reducing the number of support staff needed per attorney.21 This newfound self-sufficiency for attorneys has elevated the role of legal support staff. They’re no longer just handling paperwork or managing schedules; they are now tackling more intellectually demanding tasks like interpreting legal documents, data analysis, and even conducting preliminary legal research online. While this evolution has allowed the legal market as a whole to drastically improve its efficiency, the modern support staff role often requires more advanced training, sometimes even necessitating a paralegal certificate.

In response to these changes, the hiring process has grown more complex. Law firms now seek candidates proficient not only in traditional secretarial tasks but also in modern technological responsibilities. This need creates a dual focus in recruitment that also emphasizes prior experience with relevant software as a crucial factor.

Modern law firms are seeking tech-savvy talent who possess skills in digital case management, electronic document organization, client communication through secure online portals, and other relevant software experience.

The Uncertain Role of Generative Artificial Intelligence (AI) in Legal Practices

For many, generative AI technologies, like ChatGPT, offer the promise of alleviating some of these burdens by automating routine tasks and even drafting legal documents. But can AI really be the answer to the sector’s staffing challenges when ethical considerations make its adoption a complex decision?

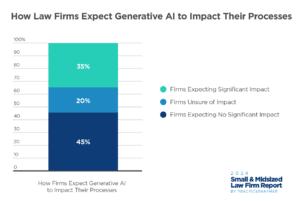

Survey data suggests that the industry is divided over AI’s potential impact. About 35% of law firms see promise in integrating AI into their daily operations, while 45% are skeptical of its value, leaving 20% undecided. This indecisiveness often stems from incidents where AI has proven unreliable or even damaging. For example, ChatGPT was implicated in a case where it fabricated legal research, costing a law firm a $5,000 fine. The court faulted the lawyers for not double-checking the data, which raises the stakes for firms considering an AI-powered solution to their staffing difficulties.22

With this in mind, firms are cautious about adopting generative AI as a fix for their personnel challenges. While AI could potentially alleviate the need for additional staff by automating specific tasks, it introduces real risks in data accuracy, bias, and ethics.

So while firms are still determining how AI can be leveraged operationally, they can’t afford to overlook present-day issues in their quest for qualified staff. As they weigh the ethical and practical risks of integrating AI solutions, they must also adapt their hiring strategies to meet the high standards that define the legal profession.

Law Firms Are Adapting to Hiring Challenges

What are law firms doing to adapt to these complex hiring hurdles? As a strategic response, some firms have taken to intensifying their screening methods to better assess the skills and qualifications of potential candidates. Others are trying to lure top talent by enhancing their compensation and benefits packages.

In a similar vein, some law firms are looking to cast a wider net for recruitment. These firms are going beyond traditional channels, extending their searches geographically and collaborating with specialized recruiting agencies.

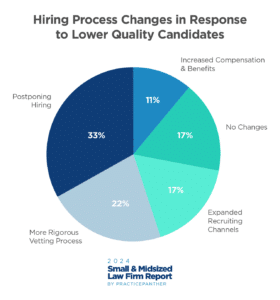

However, a notable portion of firms are taking a different route: they’re deliberately delaying hiring. Instead of settling for hiring unqualified candidates, they prefer to wait to hire the right high-potential candidate. In fact, 22% of firms have introduced more extensive vetting processes, while another 33% are postponing hiring altogether.

How is this delay in hiring impacting the day-to-day processes at law firms? Likely in more ways than one would expect.

Intensifying Competition and Rising Client Demands Amplify Growing Workloads and Staffing Issues at Law Firms

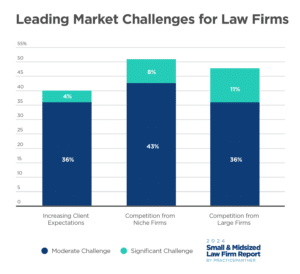

To grasp the full extent of how limited staffing levels affect law firms, it is crucial to first look at the broader market trends impacting the industry. Competition is stiffer than ever, not just from larger firms but also from niche firms specializing in certain areas of law. This environment places tremendous pressure on small and midsized firms to evolve their offerings in order to retain their market position, whether or not they have the current staff levels to efficiently support this.

One critical factor in this competitive context is the changing expectations from clients, with 40% of firms expressing apprehensions about adapting to these evolving demands. In a digitally saturated era, consumers—conditioned by real-time updates from mobile applications and digital services—are demanding more frequent and dynamic communication. Larger law firms are typically well-equipped to meet these demands, setting the industry standard.

On the other hand, small and midsized firms often find themselves in a difficult predicament. While striving to meet heightened client expectations, nearly half (47%) of these firms also grapple with the formidable presence of larger counterparts, feeling the pressure of their industry dominance. At the same time, 51% of small and midsized practices feel the heat from specialized niche firms, which bring unique expertise to the table.

Plus, the modern expectation of 24/7 availability adds further complexity, especially for those without cloud-based legal practice management (LPM) software. Firms must respond to client intake requests and schedule consultations as fast as possible to win clients over competitors. As if this wasn’t challenging enough, small and midsized firms also struggle with vetting new clients as they expand their range of services or develop specialized niches. These requirements all contribute to an escalating workload for staff.

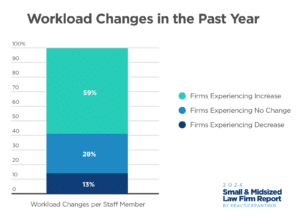

The above pressures combine with another significant obstacle: the dwindling staff levels mentioned earlier. A notable 59% of law firms report an increased workload per staff member, likely due in part to the high client demands. This issue is exacerbated by the time spent on marketing against more prominent competitors, especially as small and midsized law firms often have yet to develop scalable marketing strategies.

Given these challenges, many firms either diversify their services or focus on niche specializations. Training for newly developed services adds another layer to an already overwhelming workload. Balancing such commitments with existing responsibilities proves difficult, particularly when staffing remains static but the workload continues to rise.

These market trends, along with staffing limitations, present a complex set of operational challenges that law firms are actively working to navigate while continuing to provide a high level of service.

Although They are Working More, Many Small and Midsized Firms Face the Paradox of Lower Cash Returns on Staff Hours

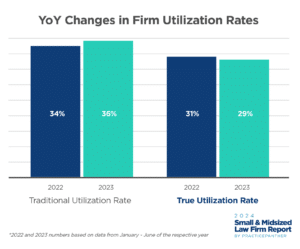

As small and midsized law firms dedicate more hours and effort to competing with large firms and balancing client demand, traditional utilization rates are up, but the cash return on incremental hours worked by attorneys is going down. From 2022 to 2023, several of the key performance indicators—like true utilization, billing realization, and collection rates—for many firms have seen a dip. These trends embody the emerging challenge of a subset of law firms to convert their increasing labor hours into commensurate increases in revenue, profits, and cash.

Staffing Challenges Hamper True Firm Utilization Rates

Utilization rate has long been used as a meaningful metric for law firms to measure attorney productivity. This rate measures billable hours worked in a day against the standard 8-hour workday. If an attorney does 26 billable hours in a week, given there are 40 standard workday hours in a week, the utilization rate is 65%.

However, the above traditional utilization rate calculation doesn’t capture the full extent of a lawyer’s commitment, especially in an era where 2,000 billable hours is a common expectation. Meeting this expectation means that a lawyer would need to work around 3,058 total hours a year, or roughly 58 hours each week.23

To get a more holistic perspective, law firms may also examine their true utilization rate, which considers the total hours an attorney works outside of the standard 8-hour workday. In this case, if a lawyer works 58 hours in a week, but only 26 of those hours are billable, the true utilization rate of the attorney is 45%.

Industry-wide, traditional utilization rates have seen a steady rise year-over-year from 2022 to 2023 due to the ongoing adoption of LPM software functionalities and features. Legal practice management software solutions are often used to streamline administrative tasks, which frees up more time for billable activities—leading to the rise in traditional utilization rates across many firms.

While traditional utilization rates have increased from 2022 to 2023, true utilization rates have slightly declined over the same period.

This is primarily due to increasing workloads affecting many law firms. Law firms who have not adopted an all-in-one practice management solution feel the bulk of this pain. With non-billable work piling higher than ever before, their staff’s true utilization rates are as low as half of their LPM-enabled counterparts.

While firms that have adopted a comprehensive LPM solution are in a much more advantaged position to combat these market challenges, they are still impacted. In understaffed small and midsized firms, lawyers oftentimes have to cover increasing loads of unfilled headcount, which inflates their actual hours worked, lowering the true utilization rate.

The temptation to extend work hours as a quick fix is not a sustainable strategy and can lead to staff exhaustion. Recent studies agree that excessive workload among lawyers can be detrimental to their mental health, which in turn compromises the quality of their work and potentially leads to billing disputes.24

Market Dynamics Impact Billing Realization Rates

Billing realization rates gauge the proportion of billable hours that are actually invoiced. Take that same lawyer who has worked 58 total hours with 26 of those hours billable. If only 22 of those 26 billable hours get invoiced, the billing realization rate is approximately 85%.

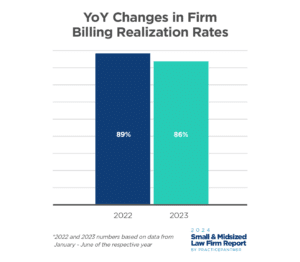

Industry-wide billing realization rates among small and midsized law firms have declined slightly between 2022 and 2023 after several years of steady improvement.

One cause of this is the practice of making concessions on billable time. In an effort to win and retain clients in a competitive market, firms often adjust or remove disputed billed time. These adjustments erode billing realization rates and also signify missed opportunities for revenue, impacting the firm’s financial position. So even when lawyers work billable hours, not all of their hours end up on invoices, which drives down billing realization rates even further.

The firms that still track their time manually have become increasingly disadvantaged in this market environment. The billing processes of these firms are prone to errors, oversights, and disputes, widening the gap between them and more tech-savvy competitors. Robust digital time-tracking software automates the logging process, captures unbilled hours, and maximizes invoicing efficiency. This puts a damper on both revenue and profits, exacerbating the issue at hand.

Overworked Staff Means Less Attention to Collection

Collection rates are a measure of invoiced amounts actually collected. If a lawyer’s 22 billed hours translate to an invoice of $10,000, but the firm collects only $8,000, the collection rate is 80%.

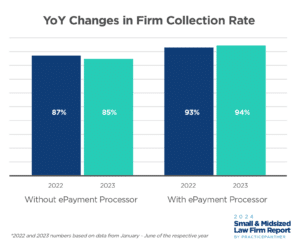

Between 2022 and 2023, there was noticeable change in collection rates for law firms. Understaffed firms facing massive workloads often see the finer points of their collection process begin to slip. This struggle is intensified during down economic times, which lead to collection delays.

Firms who do not use an LPM native ePayments solution are particularly vulnerable to collections leakage—their collection rates declined from 87% in 2022 to 85% in 2023.

Meanwhile, firms leveraging a native ePayments solution, such as PracticePanther’s PantherPayments, observe a materially higher collection rate on average and have even experienced an improvement in their collection rate. Such platforms can automate reminders, provide easy payment options for clients, and allow for real-time tracking of payment statuses. In fact, some firms using these advanced ePayment solutions see up to a 73% reduction in accounts receivable. In the absence of this kind of software, the result is a pile-up of overdue invoices and significant delays or losses in cash flow.

During uncertain economic times, cash flow and cash reserves become more important than ever. On-time collections for many firms in these times could spell the very difference between maintaining operations or missing payroll. Firms who recognize this and are able to adapt quickly

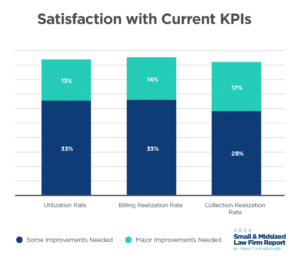

A Reality Check on the Metrics

How are firms feeling about their own efficiency metrics? A third of law firms believe some improvement is needed in their staff’s billable hours—or utilization rates—with an additional 13% stating that radical improvements are necessary. The need for change in this area is a real sentiment that echoes through many legal practices.

Moreover, nearly 30% of firms feel that their collection realization rates could be better, and another 17% have even more intense concerns about these rates. This outlook is exacerbated by the broader macroeconomic uncertainty, causing firms to more rigorously prioritize cash collections. The issue also extends to billing realization rates, where another third of firms want to see improvements and 14% think this area needs major work.

With almost half of firms expressing discontent with their performance metrics, it’s clear that fundamental operational issues need a thorough review. As they undertake this review, many leading firms are finding that LPM software can be an effective tool for improvement. Such software can boost these rates without requiring a drastic change in operations, an increasingly attractive option for firms seeking long-term solutions to ongoing challenges.

Seeking Sustainable Solutions to Existing Small and Midsized Firm Staffing Challenges

When attorneys and staff are stretched thin, the ripple effect can potentially be devastating for law firms. In a hyper-competitive market where clients have more choices and demand more from law firms, limited staff bandwidth can greatly impact the quality of legal services, client relationships, and, ultimately, firm economics.

So, what’s the path forward for small and midsized firms looking to position themselves for success in this increasingly complex and challenging market?

Part 3: The Pathway to Sustainable Growth in a Changing Market

While the legal sector shows signs of promising growth, with a projected annual growth rate of 5.18%, merely riding the wave is not a strategy for long-term success. It’s a call to innovate, particularly for modern law firms facing fluctuating client demands and increasing caseloads. Interestingly, the firms making the most of this growth opportunity often turn these obstacles into launching pads for meaningful change.

In this section, we’ll delve into what sets these thriving firms apart, focusing on the practical yet impactful measures these firms are taking to position themselves for long-term success. It’s these operational adjustments that are turning common challenges into opportunities for lasting, agile growth.

The Two Dimensions of Sustainable Growth for Small and Midsized Law Firms

For small and midsized law firms focused on navigating evolving market trends and driving long-term growth in firm revenue and cash flow, two interrelated yet distinct dimensions emerge as non-negotiables: market positioning and scalability. To truly excel in the long run, firms must effectively adapt to capture shifting market demand while possessing the internal efficiencies to retain and sustain growth.

Top-performing firms realize this growth by widening their client base through adept marketing and lead generation and also by enhancing their services for new and existing clients. At the same time, they focus on underlying returns by fine-tuning internal operational metrics such as utilization rates and collection rates. This all comes together as a balanced strategy aimed at satisfying both new and existing clients, and ensuring the firm’s long-term financial health.

While it might seem like these dimensions function independently, neglecting one could derail a firm’s long-term growth potential. Put simply, the benefit of strong market positioning is only achieved through operational efficiency and scalability, while optimal scalability without market presence and positioning leaves firms with unrealized potential.

Unpacking the Importance of Market Presence and Positioning for Law Firms

In the legal sector, market presence and positioning are pivotal for a firm’s long-term success. Market presence, often gauged by metrics like website traffic and brand visibility, is the foundation upon which firms build awareness. It’s a crucial entry point, particularly when prospective clients have a plethora of choices and nearly half of small and midsized firms see competition from larger firms as a major hurdle.

Market positioning, on the other hand, refers to how firms distinguish their offerings from that of their competitors. One of the most proven and impactful examples of this involves firms’ ongoing improvements to exceed clients’ increased expectations for superior communication and robust systems to manage client relationships. Through these efforts, firms are able to establish a reputation as a market leader in terms of quality of service. Another example may include firms honing their offerings to align to specific practice areas or geography where they are poised to meet an underserved market, thus carving out a strategic advantage over less nimble competitors. By adopting these client-centric approaches to their offerings, firms can not only gain awareness from prospective clients, but effectively land and retain them.

As the industry experiences rising competition and increasing client demands, firms are seeking innovative ways to effectively position themselves in the market.

Neglecting such tactics in market presence and positioning could leave law firms at a disadvantage. As the industry grapples with challenges like rising competition and increased client demands, firms that don’t adapt could find themselves sidelined.

That’s why leading firms are adjusting their sails now to set themselves apart, from implementing novel digital marketing strategies to reimagining their service offerings and engagement models. These proactive approaches address immediate challenges while also preparing firms for future success.

Having explored the exterior battles of presence and positioning, let’s turn inward to another essential strategy: scalability. As we move forward, consider these frameworks a primer for the comprehensive playbook we’ll delve into later.

Exploring the Role of Scalability in Law Firms

The role of scalability as it pertains to law firm growth potential can be thought of as each firm’s ability to absorb a growing client base, as defined by its operational efficiency. Firms that stand out in the market owe a significant part of their repeatable success to this dimension. While market presence and positioning cast the net, it’s the internal workings—especially the degree of automation—that define how much firms can pull in without breaking their seams.

Firms that rely too heavily on legacy systems and manual processes can often experience crippling bottlenecks that undermine their growth potential. In these settings, legal professionals find themselves spread thin, juggling various roles from administrative tasks to client acquisition. And while small and midsized firms start at this place, leading law firms are pushing the envelope by migrating from manual systems to automated ones, targeting key areas like initial client interactions, document management, billing procedures, and more.

By automating these critical areas, firms can elevate service levels without ramping up overhead, creating a win-win scenario. Firm owners avoid the need for more hires or price cuts while also enhancing their team’s well-being, preventing burnout, and setting the stage for a more sustainable practice.

Implementing the Playbook to Achieve Sustainable Growth

To unlock sustainable growth in 2024, law firms must equally invest in market positioning and scalability. We will take a deep dive into the methods that are paying off for top firms and how law practice management software is playing a critical role in achieving this. And while every software offering can come with various features and capabilities, we’ll cover how top-performing firms are leveraging the leading all-in-one practice management platform, PracticePanther, to enable their growth.

To unlock sustainable growth in 2024, law firms must equally invest in market positioning and scalability.

Improving Market Positioning Through Firm Reporting

As discussed, prospective clients are now inundated with more choices than ever. In a market crowded with diverse competitors, from large firms to niche players or DIY platforms, law firms face the pressing challenge of both attracting and retaining clients. By identifying key performance metrics, these firms are able to pinpoint opportunities to enhance client satisfaction, expand the range of their services, and increase brand awareness.

While this comprehensive review may seem like a hefty task for firms that are just beginning to focus on growth, it’s far from insurmountable. Many are utilizing specific metrics to guide their decision-making, helping them choose the most effective strategies tailored to their unique circumstances. Below is a list of some of the most common assessments small and midsized firms are performing to hone in on these strategies:

1. Measuring and investing in client satisfaction

In order to better understand how their firm’s offerings are stacking up against their competitors, many law firm leaders are going directly to the source—their customers. Tracking metrics such as net promoter score (NPS) or customer retention rate can identify where a firm’s services may need improvement.

Additionally, law firms are leveraging custom reporting features in their practice management software to uncover operational bottlenecks that cause friction for clients. For instance, through PracticePanther’s productivity reports, AR aging reports, and task reporting features, law firm leaders can pinpoint these issues. Often, law firms find that client-facing processes—such as intake, scheduling, or document completion— are the major culprits, and once streamlined through operational improvements such as staff training or automated task completion, client satisfaction can begin to rise.

When a firm’s NPS rises and retention rates improve, the revenue implications are direct and significant. By using custom reports in law practice management software to identify and eliminate operational bottlenecks, the cost savings directly increase profitability.

2. Assessing opportunities for expansion and specialization

With robust practice management software on hand, law firms are able to use a variety of reports to strategically look for new avenues of business. With Originating Attorney Reports, available natively in PracticePanther, firms are discovering who and/or what area of business is bringing in the most revenue.

Alternatively, leaders are measuring profitability by practice area, geographical location, or case type to direct expansion efforts in a strategic fashion. These data insights are only made possible by the built-in custom tagging features of PracticePanther and are instrumental in finding these growth opportunities. Custom tags allow users to add unique identifiers onto calendars, matters, and contacts, enabling the generation of comprehensive reports such as commission reports, productivity reports, and originating attorney reports. This flexibility allows for nearly unlimited insights and arms law firm leaders with the exact information they require.

Pinpointing specific areas of profitability allows for targeted marketing efforts and resource allocation. This data exercise is a strategic initiative that has proven to expand revenue streams for many firms. When coupled with reduced operational costs achieved through automated features, the net result is a highly profitable and agile law practice that is equipped to pivot as market demands evolve.

3. Maintaining visibility where clients are looking

Law firms who are winning in this increasingly competitive market know exactly where their messages need to be in order to reach and resonate with their target market. While the approach will be different for each firm, most successful firms are leveraging proven channels, including their own website, social media, Google Business profiles, and even traditional marketing channels like television or radio.

To understand where to place the firm’s messaging, law firms are again utilizing built-in reporting in their practice management software to measure key performance indicators. For example, looking at PracticePanther’s Matters Over Time Report can help firms gauge which type of matter is growing at the fastest rate, while the Billable Amount By Matter report can help identify which matters are bringing in the most revenue. Firms are getting even more granular by using custom tags on new contacts so they can pull reports that identify which channels are bringing in the most new clients and revenue.

Using the information gleaned through these reports, law firms can understand where their marketing budget allocation is generating the largest ROI, informing them of prime areas for continued investment. Given the overarching extent to which small and midsized firms are prioritizing their marketing budgets over the next year, these insights are proving an invaluable part of the strategic planning process for many law firms.

Automating Firm Processes to Increase Scalability

As outlined in this report, small and midsized firms that are poised for growth employ a dual strategy that involves enhancing their market positioning while simultaneously optimizing internal operations through the automation of repetitive administrative tasks. This powerful combination serves as the key to effective scaling, eliminating the need for additional staff workload and instead affording staff the time to focus on billable work. The outcome is a notable increase in profit margins as firms achieve higher billable hours with their existing staffing levels.

But how do these forward-thinking firms determine which processes to automate? The starting point for most firms is a deep dive into the operational bottlenecks that directly affect their most critical KPIs—staff utilization, billing realization, and collection rates. By moving many of the firm processes that inform these rates from manual operations to more automated ones, law firms can position themselves to absorb firm growth while benefiting from a more efficient and financially productive practice.

Small and midsized firms who are poised for growth employ a dual strategy that involves enhancing their market positioning while simultaneously optimizing internal operations through the automation of repetitive administrative tasks.

Small and midsized firms aiming to generate the most significant return on their operational improvements prioritize five key areas for automation adoption:

1. Client Intake

One of the most crucial times during any case is client intake, and the process a law firm has in place can make or break a working relationship before it begins. For instance, if a client’s initial contact form is buried in a partner’s crowded inbox, or worse, misfiled in a disorganized document management system, the prospective client may not get a response for days or even weeks.

Similarly, outdated techniques like paper-based questionnaires eat up attorney and paralegal hours with manual data entry each week. These inefficiencies lead to wasted non-billable hours and will result in the firm losing potential clients to competitors who have smoother, more efficient onboarding processes.

This is why firms are pivoting toward seamless intake processes facilitated by law practice management software. For instance, PracticePanther enables firms to create custom client intake forms and place them anywhere on their website, allowing clients to fill them out from any device. This information is synced instantly in PracticePanther, getting clients through the door faster, removing the need for manual data entry, and initiating cases immediately.

Firms can make client onboarding even more efficient through the use of automated follow-up emails. Providing instant communications with the next steps not only enhances the customer experience, but the streamlined process can lead to an increase in referrals and more business—all without manual effort from staff.

Such alignment between improved client intake and enhanced financial performance is a clear example of how modern law firms are optimizing their operations for growth and profitability.

2. Time Tracking and Billing

While accuracy remains paramount in time tracking and billing, the most successful law firms also keep efficiency top-of-mind. By adopting digital solutions to automate and streamline such processes, these industry leaders can ensure that every billable hour is accurately recorded, contributing to higher utilization rates. Additionally, precise time tracking minimizes concessions on billable hours and has a significant effect on a law firm’s financial performance, impacting both invoicing accuracy and collection rates.

Modern practice management software offers time-tracking features that enable staff to log their hours automatically while they work. This approach produces more accuracy in reports and eliminates the need for manually filling out timecards at the end of the week or month. Firms utilizing PracticePanther’s time-tracking features see various advantages, including the use of multiple timers for ongoing work tracking and capabilities to boost cash flow. PracticePanther’s MoneyFinder feature, for example, allows staff to identify unbilled events, tasks, emails, notes, and calls that haven’t been logged in a timesheet yet, ensuring that no billable hours fall through the cracks.

3. Payment Processing

Amidst economic uncertainties and a growing emphasis on timely payment collection, law firms are actively pursuing opportunities to automate previously manual payment processing systems. By embracing legal-specific online payment processors, firms can significantly alleviate the administrative burdens associated with tracking and collecting outstanding payments while making the payment process easier and faster than ever for clients.

Efficiency-focused law firms are turning to ePayment systems, such as PracticePanther’s PantherPayments, to automate reminders, offer convenient payment options, and provide real-time payment tracking. The absence of such software can lead to a backlog of overdue invoices, creating substantial disruptions in cash flow.

Moreover, cutting-edge ePayment systems like PantherPayments cater to the evolving needs of end clients, whether it involves offering greater flexibility in their interactions with the firm or providing more options for bill payments during challenging financial periods. For example, firms maximizing PracticePanther’s ePayments capabilities are experiencing remarkable reductions of up to 73% in accounts receivable. They achieve this through strategies that include:

- Conveniently placing unique payment links on their websites.

- Implementing flexible payment plans to ease the burden of lump-sum payments on clients.

- Utilizing automated messaging to remind clients to pay their invoices promptly.

In a climate where law firms are actively seeking ways to enhance their collection rates without overburdening their administrative processes, online payment processors are empowering them to optimize their financial operations while offering clients the flexibility they need.

4. Client Communication

Practicing law inherently requires lots of communication, and firms that are stuck using outdated or redundant methods find themselves struggling to scale to meet today’s evolving client demands. Luckily, modern legal practice management software comes with innovative features like text messaging, automated emails, and robust client portals to streamline communication. Such features centralize interactions, reducing the risk of lost productivity that can occur when communication happens through various unrelated channels.

This streamlining of communication is often a result of automating repeatable steps that help speed up a particular set of tasks. Whether that’s during the intake process or billing period, efficient firms are automating communication to better serve clients and track case progress.

Utilizing workflows in an LPM software like PracticePanther, lawyers can easily schedule client appointments, freeing up more time for billable work. Workflows also centralize case updates, reducing the risk of missing critical information and leading to more accurate invoicing and higher billing realization rates. When firms enable quick and quality client responses in this manner, clients are motivated to promptly address invoices, minimizing any delays and guaranteeing timely compensation for legal services.

5. Document Templates

One of the largest bottlenecks that eat away at a law firm’s billable hours is document management. With countless documents requiring creation, input, and filing, staff can become overwhelmed quickly. To combat this particular issue, successful firms are turning to automated document templates.

Using PracticePanther’s customizable document templates, for example, law firms are able to automatically populate documents with client and case information directly from their PracticePanther account. This means staff no longer needs to manually re-enter this data for every case. By applying these pre-set, case-specific documents to clients or matters, law firms quickly generate completed documents. This straightforward process saves time and effort, breaking down significant productivity barriers for both the client and the firm.

As the market evolves and small and midsized firms are tasked with responding in ways that meet client needs while also preserving firm returns, operational efficiency is a must. These five processes present a low-hanging opportunity for all firms to begin their journey of preparing their law firm for increased scalability and growth. Any contemporary law firm should rely on these five operational processes to function effectively.

Future-ready law firms are investing in automation across client intake, time tracking and billing, payment systems, communication channels, and document management to outpace competitors and drive growth.

What Legal Leaders Look For in Practice Management Software

As we head into 2024, it’s clear that nimble and powerful practice management software is among the leading ways to orchestrate the symphony of efficiency and profitability within law firms. And while the use case is clear for most firms, determining where to get started is typically not as straightforward. Among the most salient questions that arise is, “How do I select the right software for my practice?” Yes, the spectrum of available options can be vast; however, the path to choosing the right legal software is marked by distinct considerations we will review below.

All-in-One Functionality

Small and midsized law firms that are the most well-equipped for long-term growth are using an all-in-one practice management software that doesn’t require multiple subscriptions or add-ons in order for it to work properly. All-in-one platforms have everything a firm needs to operate in a single place, including case and document management, time tracking, calendaring, invoicing and billing, online payments, eSignature, client portals, and more. This powerful combination of features in a single system allows law firms to have built-in workflows that streamline tasks, reduce duplicative data entry, and altogether push work along faster.

User Friendliness

Leaders are only investing in resources that they know will be used by their staff. They’ve put user-friendliness toward the top of their wishlist because they won’t get the same ROI if a platform is outdated or difficult to navigate. Leaders are looking for platforms that have a modern design, a simple and easy-to-read layout, and efficient navigation that requires as few steps or clicks as possible. For instance, having to work in multiple tabs to perform a single task in a platform could cause confusion—if staff find a platform difficult to use, they won’t rely on it, and it might even hinder productivity.

Cloud Native

In a remote or hybrid environment, being able to access work documents from anywhere has become paramount. When choosing law firm software, decision makers are putting an emphasis on cloud products over on-premise legacy systems that require being in the same location as a server to get work done. In a world where business can be conducted anywhere, having to go back to the office just to access case files can be a major hindrance. On-premise systems are also prone to increased downtime as well as a higher cost of maintenance, both factors that are headlining the shift to the cloud.

Convenient Migration and Onboarding

The ability to use software quickly upon purchase is among the most critical factors for leaders to consider. Partners are looking for software that can guarantee a quick turnaround from one platform to another while providing a complete migration and structured training for staff. Without these considerations, law firms could be stuck in a period of limbo while migrating information without the ability to serve clients effectively.

Small and midsized law firms are leveraging PracticePanther's industry leading features to help them achieve greater efficiency and higher returns heading into 2024

Refining the Path Forward with PracticePanther

The legal sector is a complex interplay of challenges and opportunities. While law firms are busier than ever before, this hasn’t automatically translated into higher profits. We’ve scrutinized the challenges in hiring, the pressure of increasing competition, and the evolving demands from clients. With all this in mind, what’s next for firms seeking to effectively navigate the emerging trends in the market chart a sustainable path towards long-term growth?

The answer comes in leveraging actionable insights and strategies into a roadmap for success, and that’s where PracticePanther comes in. Our software serves as a dynamic partner, adapting to emerging trends and the unique nuances of your law firm.

So, if your firm is looking for meaningful growth, adopting the ultimate, all-in-one legal practice management platform that aligns with your complex needs and future aspirations is crucial. PracticePanther proactively engages with the issues in this report, offering a sophisticated strategy to turn challenges into advantages. As the legal sector navigates the ongoing economic uncertainties, aligning with a comprehensive case management solution could very well be the difference between status quo and transformative growth.