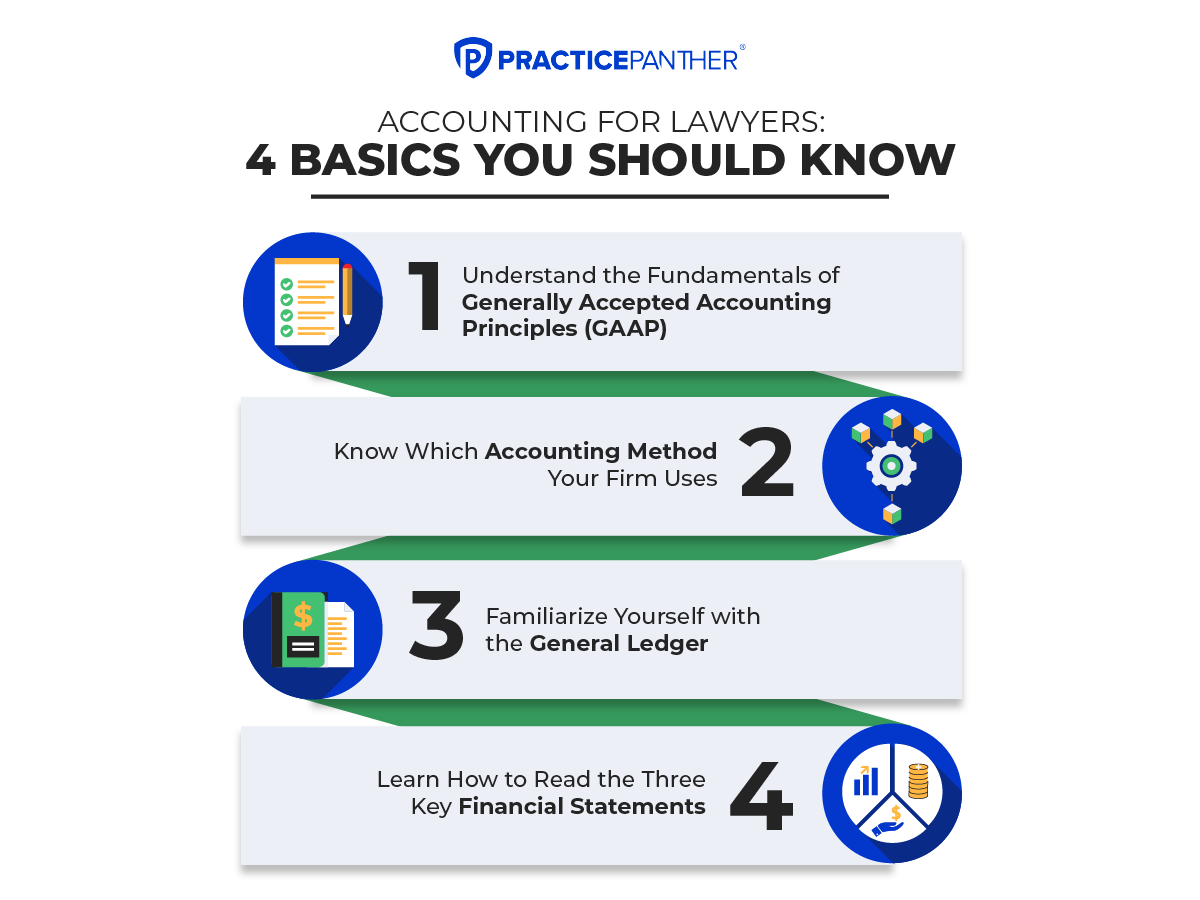

Generally Accepted Accounting Principles (GAAP) are common accounting rules, standards, and procedures developed by the Financial Accounting Standards Board (FASB). GAAP often serves as the foundation of the framework used by many law firms to help guide proper financial accounting and the preparation of financial statements. The overarching goal of GAAP is to ensure all companies, including law firms, consistently craft financial statements that are complete and comparable. The ability to remain consistent with your accounting needs and maintain meticulous record-keeping processes provides better protection to lawyers and their law firms in the event of an Internal Revenue Service (IRS) audit.

When you work with an accountant, they handle all the GAAP issues that are required to file taxes and address other accounting issues for your law firm. You shouldn’t be expected to know all the details of GAAP, as it’s a lot to learn. But knowing the basics can help you work with your accountant more easily, which benefits your law firm and all its employees. For example, is there a better way to track or provide the specific information you send to the accountant? Could you make changes to help your accountant prepare and complete financial documents for you?

Law firms have many accounting details that must be addressed, and accountants must make sure everything they are processing and providing to your firm, the IRS, and other required entities is following GAAP correctly. While it is the accountant’s job to handle this the right way regardless of anything else, working with the accountant to make things easier can be very valuable for your business relationship.

Accounting is not just about getting all the accurate numbers into the right category to get information on how well your law firm is doing. There’s more than one accounting method, and they are not handled the same way. Even though it is your accountant doing the work, you should know what method of accounting your firm uses and understand the basics of how that method works. When it comes to accounting for lawyers, there are three standard methods for law firms to adopt:

Bookkeeping for lawyers will always involve using and managing a general ledger. A general ledger is a complete record of a law firm’s financial transactions, separated into transaction types, including assets, liabilities, revenues, expenses, and owner’s equity. This data is required to create accurate, defendable financial statements. The general ledger will also be the basis for your double-entry bookkeeping system. The double-entry accounting method tracks where a lawyer’s money is coming from and where it’s going. Two entries are made for each financial transaction — a “debit” and a “credit.” These entries are recorded in the general ledger to demonstrate whether the funds are being transferred to or from an account.

If you have never seen your general ledger or don’t look at it very often, it is time to change that. Finances are one of the most critical areas of your law firm, and you should be involved with them. While your bookkeeper will be handling all the daily tasks of adding, subtracting, and balancing, you need to be aware of where your firm’s finances stand and how those finances got to where they are. A standard report can tell you the first piece of information but not the second one.

Financial statements are the reports your law firm needs to have detailed information regarding where your finances stand and where they look to be heading. For example, if there is a problem with cash flow, it is always best to find that out sooner rather than later. If you aren’t looking at the key financial statements, though, or you don’t understand how to read them, you could miss crucial information you will require to make vital decisions about the future of your law firm. Accounting for lawyers boils down to three key financial statements:

These three statement types serve as information resources to provide insight into a firm’s financial performance, strength, and overall value.

Once you master the basics of accounting for lawyers, you can better navigate the everyday challenges unique to the legal industry. Here are the top three issues to look for in your practice, along with proven solutions to consider.

Client trust accounting is the process of monitoring and tracking the cash funds a lawyer has received on behalf of or belonging to a client or a third-party entity. Trust account funds must never be mixed with firm operating funds, as it can induce potential accounting mistakes — including reporting trust accounts as income, mixing client and business accounts, and charging clients processing fees. One way to manage recurring client trust accounting errors without putting more strain on your lawyers and paralegals is to leverage law practice management software. Practice management solutions provide custom reports for every client trust account and include built-in payment capabilities to encourage streamlined organized client payments.

When bookkeeping for lawyers, differentiating income from revenue is a common challenge because a portion of the funds are used to cover incurred costs and should not be factored into income. Deploying law practice management software is a simple method to track incurred costs in real-time and correctly subtract them from firm income. Software solutions help accurately reflect proper income and even help avoid compliance issues come tax time and regulatory review.

Aside from revenue and income, tracking billable hours can also be challenging for busy lawyers and law firms. Tracking billable time is a time-consuming and error-prone task that can significantly disrupt workflow without good record-checking practices. As an essential component of law firm success, use law practice management software to track billable time in real-time from any device and maintain confidence that all billable hours have been documented.

If accounting for lawyers seems intimidating, a robust knowledge of the basics can help every practice avoid common mistakes. Familiarize yourself with the generally accepted accounting principles (GAAP) for financial statements that are complete and comparable. Then, review your general ledger to better understand your law firm’s financial transactions. Once you’re geared with this information, refresh your knowledge on how to read the critical financial statements for your practice, like the income and cash flow statements and balance sheets. From here, review common issues that complicate accounting for lawyers, so you can better navigate your financial management process and avoid the challenges other practices may face. Want more tips for bookkeeping for lawyers? In the next chapter of PracticePanther’s Law Finance guide, we’ll look at best practices for billing for lawyers and law firms.