When setting a contingency fee, you’ll want to consider several factors to ensure it’s fair to both you and your client. Typically, contingency fees range from 25% to 40% of the total recovery amount. The standard often hovers around 33.3%, particularly for personal injury cases. However, the specifics can vary depending on the complexity of the case, the risk involved, and the jurisdiction.

To effectively determine your fee, you must weigh the potential risks and rewards, evaluate the details of each case, and understand the financial dynamics at play. From assessing the level of effort required to navigating jurisdictional limitations, setting a fair and competitive contingency fee is an art that balances client accessibility with professional sustainability.

In the following sections, we’ll explore these considerations further, offering practical tips and insights to help you establish a contingency fee structure that aligns with your practice and ensures client satisfaction.

What Is a Contingency Fee?

A contingency fee is an arrangement where your payment as an attorney depends on successfully winning the case. In this setup, you agree to accept a predetermined percentage of the client’s recovery amount, which could come from a settlement or a court judgment. So, if your client doesn’t win the case, you don’t receive a fee for your services. This fee structure is designed to make legal representation accessible to clients who might not be able to afford to pay upfront or hourly fees.

The best contingency fee example is an attorney in a personal injury case charging a 33.3% fee if the case settles quickly. If the case proceeds to trial, the attorney may increase the fee to around 40% due to the additional time and resources required.

There may also be other case-related expenses that are not included in the contingency fee. These can include court filing fees, costs for obtaining records, copies, fees for expert witnesses, etc. Such expenses are typically outlined in the fee agreement and may need to be covered by the client, either upfront or out of the recovery amount.

Lawyers who use contingency fees, often called “no win, no fee” lawyers, can practice in many specialty areas. However, it’s important to understand the rules around this fee structure and what type of cases you can apply it to. What is the contingent fee rule, exactly? According to the American Bar Association Model Rule 1.5(d), contingency fees are explicitly forbidden in criminal defense matters. This limitation exists because ethical rules and statutes prohibit contingency fees in criminal cases, as they could encourage improper incentives and compromise the lawyer’s duty to seek justice.

Why Do Lawyers Take Cases on Contingency?

When considering why to take cases on contingency, think about the broader impact and strategic advantages this approach offers:

- Access to Justice: Contingency fees enable clients without financial means to pursue their claims without upfront costs.

- Client Trust and Commitment: Taking a case on contingency demonstrates your confidence in the case and aligns your interests with the client’s.

- Potential for High Reward: Contingency cases offer the possibility of substantial payouts, sometimes making the financial risk worthwhile.

- Market Competitiveness: Offering contingency fees can attract more clients by minimizing their upfront costs and financial risk.

- Strategic Case Selection: Contingency fees encourage you to focus on cases with strong merits and high chances of success.

Embracing contingency fees can elevate your practice, providing financial rewards and fostering stronger client relationships. This model showcases your dedication to achieving positive outcomes for those who need it most.

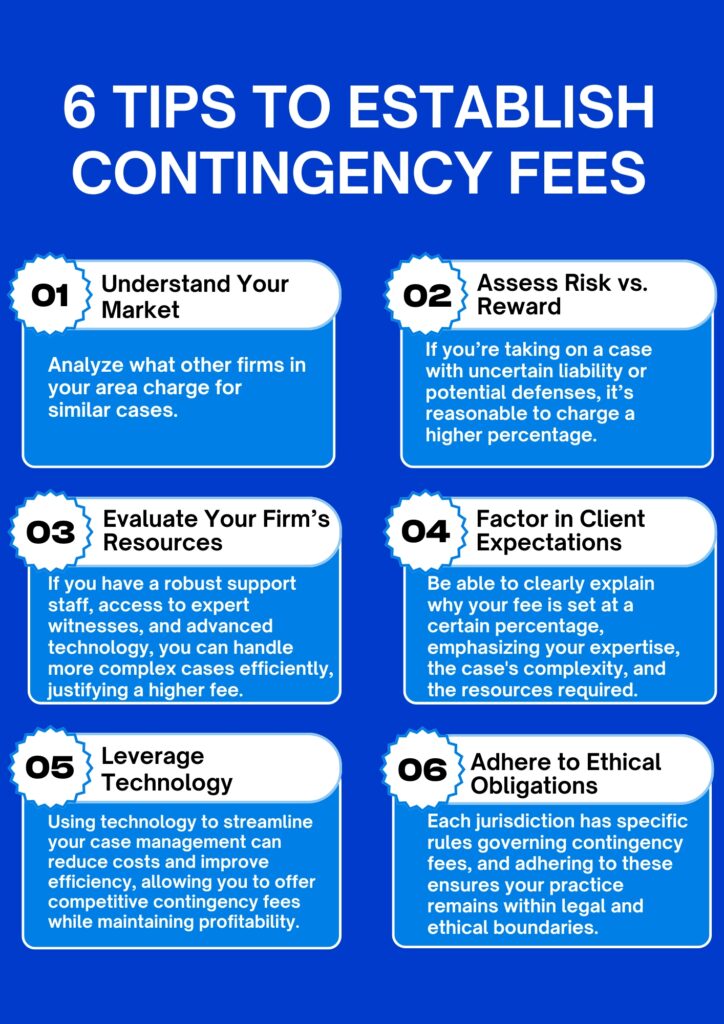

6 Tips To Establish Contingency Fees

Here are six insider tips for determining your contingency fee amount:

1. Understand Your Market

Analyze what other firms in your area charge for similar cases. This can give you a competitive edge and help you position your services effectively. For example, in a competitive market like New York City, you might find that most firms charge between 30-40% for a contingency fee. If your firm has a strong track record and you offer personalized client services, you could justify being at the higher end of that spectrum. Conversely, if you’re just starting, you might start slightly lower to attract more clients initially.

2. Assess Risk vs. Reward

Contingency fees are inherently risky because payment depends on winning the case. Higher-risk cases should command higher fees. If you’re taking on a case with uncertain liability or potential defenses, it’s reasonable to charge a higher percentage.

For example, a high-risk civil rights case with uncertain outcomes might warrant a 40% fee, whereas a clear-cut liability case with high settlement potential might be appropriately set at 30%. Balancing the risk with potential reward ensures your firm is compensated for taking on challenging cases.

3. Evaluate Your Firm’s Resources

Your firm’s capacity and resources play a big role in setting contingency fees. If you have a robust support staff, access to expert witnesses, and advanced technology, you can handle more complex cases efficiently, justifying a higher fee. A solo practitioner, on the other hand, might need to charge less than a larger firm with a dedicated team for every aspect of a case. If your firm can provide top-tier resources and a higher chance of success, this added value can justify a higher fee.

4. Factor in Client Expectations

It’s best to always manage client expectations upfront. Some clients might balk at a higher fee, even if it’s justified. Clearly explain why your fee is set at a certain percentage, emphasizing your expertise, the case’s complexity, and the resources required.

For instance, if a client hesitates at a 35% fee for a medical malpractice case, break down the costs associated with negotiating, conducting thorough research, and preparing for a potentially lengthy trial. Transparency helps clients understand the value they’re getting.

5. Leverage Technology

Using technology to streamline your case management can reduce costs and improve efficiency, allowing you to offer competitive contingency fees while maintaining profitability. If your firm utilizes legal practice management software for case management and organization, you might be able to reduce the time spent on each case, justifying a more competitive fee. Highlighting these efficiencies to clients can also demonstrate your firm’s commitment to delivering cost-effective legal services.

6. Adhere to Ethical Obligations

When setting your contingency fee, you must comply with ethical obligations and state regulations. Each jurisdiction has specific rules governing contingency fees, and adhering to these ensures your practice remains within legal and ethical boundaries.

Florida attorneys, for example, must follow Rule 4-1.5 of the Florida Bar, which outlines the permissible structure for contingency fees. According to this rule, a contingency fee agreement must be in writing and signed by the client and attorney, with a clear statement of the percentage that will be charged. The rule also caps fees in personal injury and medical malpractice cases, generally allowing a maximum of 33.3% before filing an answer or demanding the appointment of arbitrators, and 40% after. By strictly adhering to these guidelines, you demonstrate your commitment to ethical practice and protect your firm from potential disputes or disciplinary actions.

How To Calculate a Contingency Fee with Legal Software

As you can see, setting a fair and competitive contingency fee involves considering several factors, from understanding your market and assessing risks to leveraging technology and following ethical guidelines. To manage these elements effectively, using legal software can make a significant difference.

PracticePanther, the all-in-one legal practice management software, can simplify the process of calculating and managing contingency fees. With its advanced features, you can track time, expenses, and case progress efficiently. It also enables you to generate detailed reports that help assess the risk and reward of each case, ensuring your fee structures are fair and competitive. One standout feature is the ability to quickly generate a standard contingency fee agreement, enhancing transparency with clients and saving you time.

Experience the benefits of PracticePanther in enhancing your practice’s efficiency and client satisfaction. Sign up for a free trial or demo today to see how it can streamline your approach to setting and managing contingency fees.