You can view the on-demand recording of this webinar here.

Practicing law can be risky as even the most experienced lawyers can make unintended mistakes, leaving them susceptible to lawsuits. The ABA reports that 4 out of every 5 lawyers will get sued at least once in their career, and that is just related to malpractice exposure. Unfortunately, many practitioners are not proactively thinking about managing law firm vulnerabilities and their financial risk.

In this webinar, Libby Luff, Strategic Partnerships Manager with PracticePanther, and Brad Barkin, VP of the Law Practice at Embroker, discuss law firms’ greatest areas of exposure, how to avoid these pitfalls and ways to protect your firm if the unthinkable happens.

Industry Trends in Legal Risk Management (7:36)

The last 3 years have undoubtedly been a challenge for law firms to navigate. Many firms found themselves uprooting their traditional practices while dodging the aftermath of the COVID-19 lockdowns. Between these two business-altering instances, some firms found themselves in a legal bind they weren’t prepared for.

Legal risk management is an ongoing protocol for law firms, but there are always unforeseen risks hiding in the shadows. One of those risks is malpractice claims. Over the last 4 years, the legal industry has experienced an uptick in the severity of malpractice claim payouts stemming from larger firms, with 90% of insurers participating in a $50 million claim in just the last 2 years.

While these numbers are staggering, the risks were always there. The pandemic simply highlighted hidden gaps in many law firms’ operations that could leave them susceptible to lawsuits.

Common Legal Risk Management Mistakes

To mitigate risk, firms must understand the risks. In some cases, the risk sticks out like a bright red flag, but in other instances, it’s not so apparent.

A few common legal risk management mistakes include:

- Attorney migration: Lateral hiring across lawyers and associates has increased due to the shift in workforce demand for hybrid or remote working environments. This can subject law firms to malpractice claims if they don’t conduct proper due diligence, like reviewing the former firm’s insurance coverage or identifying pending claims on the attorney.

- Conflict checks: The most crucial step in taking a new client is the conflict check process. Law firms must conduct all necessary conflict checks to ensure confidentiality, such as reviewing background checks, criminal records, prior cases, or attorney-client relationships.

- Cybersecurity and data management: As more law firms conduct business online, they must comply with rules and regulations to mitigate risk and ensure the confidentiality of information as outlined by the ABA. The ABA also offers several ethical guidelines and recommendations for cloud-based computing for law firms.

Now more than ever, it’s important for law firms to get back to basics. This means enforcing policies for documentation and document management, cybersecurity, and hiring protocols, to name a few.

Importance of Law Firm Insurance (25:37)

Some law firms are solely focused on generating new business and the client experience without considering how to protect themselves. Managing a successful law firm requires taking on some risk, but there are safeguards like law firm insurance that can mitigate the severity of a negative situation.

It’s important to note that the risks to your firm can come both internally and externally. Here are a few law firm risks to be aware of:

- Malpractice

- Property Damage

- Injuries on the Job

- Ransomware

- Theft

Finding the Best Law Firm Insurance

To protect your firm from the risks previously mentioned, you need to have the proper law firm insurance in your corner. There are several options for business insurance on the market, but you want to make sure you have a policy that offers coverage tailored to law firms.

PracticePanther’s preferred insurance broker, Embroker, is the highest-rated business insurance for law firms with several policies to cover their business, including malpractice insurance or legal professional insurance. Legal professional insurance covers a wide variety of risks and protects your firm in case of a lawsuit. Unfortunately, this coverage is often overlooked by some law firms leaving them at risk for costly claims or litigation.

While the requirements for insurance at your firm can vary by state or even landlord — it’s important to have the fundamentals of law firm insurance like professional liability, cyber liability, and workers’ compensation to protect your firm.

Master Legal Risk Management with Cloud-Based Legal Software (55:00)

Legal risk management, malpractice, legal claims — it can all get overwhelming. The silver lining is that there are solutions law firms can implement to mitigate risk day-to-day. Coupled with the proper law firm insurance, cloud-based law practice management software is an easy way for law firms to keep their data and other information in a centralized location.

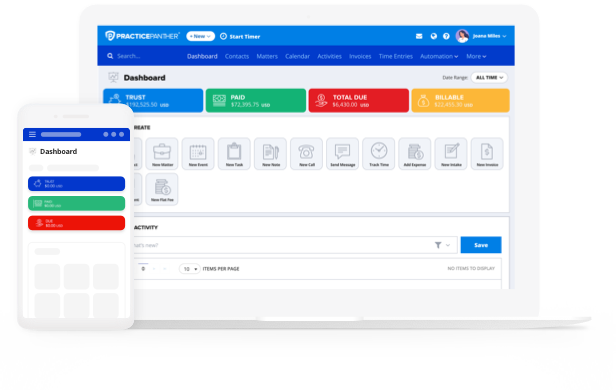

Managing your practice on a server or in multiple locations leaves room for cybersecurity breaches or missing key details during the conflict check process. PracticePanther offers an all-in-one solution that allows firms to manage every aspect of their business with features that help support law firms with legal risk management, including:

- A cloud-based platform that is accessible from anywhere and performs automatic software updates to ensure security

- Document management to keep information up-to-date, maintain document version control and collaborate with internal and external parties

- A client portal to keep an open line of communication with clients and easily document correspondences

- Automated workflows to trigger specific tasks like performing conflict checks during the onboarding process to identify any risks

Be Proactive About Legal Risk Management at Your Firm

Protecting your firm from unforeseen risk starts with the process and policies you implement today. To educate yourself on legal risk management, see real-life claim examples, learn how how to navigate expensive claims, and understand how a robust legal practice management solution like PracticePanther can help reduce your overall risk, you can view the full recording for deeper insights and resources on safeguarding your firm.