Why Clear, Professional Invoices Matter

As an attorney, you put your expertise and hard work into every case you handle. But when it comes time to bill those clients, a confusing, poorly structured invoice can compromise the well-earned trust you’ve built—resulting in client friction, delayed payments, or even doubt in the value of your services.

Think about it this way: Your legal invoices are more than just payment requests, they tell the story of the work you put in for your clients. Since legal services often deal with intangible results, your invoice is one of the few tangible items a client can walk away with that shows the value of your work.

To help you maximize the effectiveness of your invoices, we’ve assembled a set of free legal invoice examples and templates tailored to various billing structures. We’ll also cover best practices to ensure your invoices are transparent and compliant and help you get paid on time.

Let’s dive in.

Legal Invoice Template Examples for Different Fee Structures

Choosing the correct invoice format depends on your law firm’s practice area(s), billing arrangement, and client expectations. Whether you bill by the hour, charge a flat fee, require retainers, or work on contingency, structuring your invoices properly will improve transparency and streamline payments.

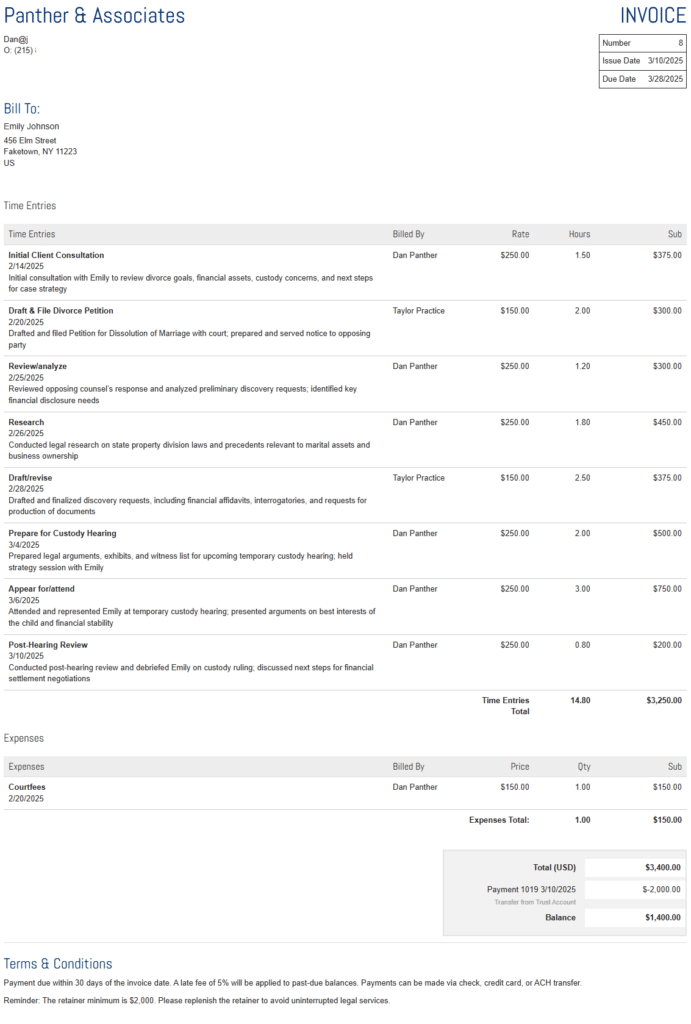

Hourly Rate Invoice Template Example

Hourly billing is by far the most common structure among law firms, but it requires clear, detailed invoices to prevent client disputes. If your firm bills by the hour, your invoices should include:

- A breakdown of the exact time spent on each task

- A detailed description of the work performed

- The billing rate for each task or attorney/paralegal working on the matter

- The total cost per task and the final amount due

Many firms use the Billing Increment Chart to ensure consistency. This chart converts minutes into tenth-hour increments (e.g., 1 to 6 minutes = 0.1 hours). This conversion helps firms prevent billing discrepancies while capturing every billable minute.

Here’s an hourly invoice example where you’re billing a client for a contested divorce:

💡Pro Tip: Consider adopting a law practice management software that includes time tracking to help you easily capture time entries. With PracticePanther, for example, you can track time as you go and automatically apply those entries to your next invoice.

Retainer Invoice Template Example

Law firms commonly require client funds to be secured as a retainer before starting work on a case. The retainer, or trust account, is then charged for the billable hours and expenses accrued while working on the case. Retainer invoices are similar to hourly invoices but also include:

- The client’s starting retainer balance

- Payments deducted from the retainer

- The remaining balance after the invoice is applied

If you’ve agreed to an evergreen retainer upfront, include a reminder of the minimum balance you decided upon and that the client must ensure the retainer is replenished before passing that minimum to avoid disruption.

We recommend using an online client portal to update your clients’ trust account balances in real-time. If their balances are close to the minimum, they will receive reminders to add more funds.

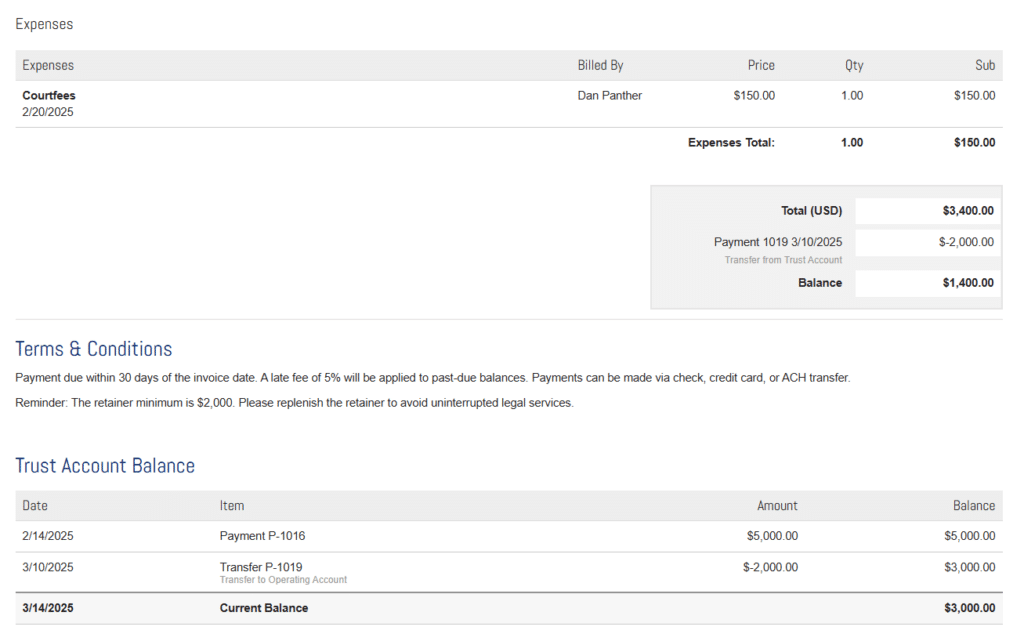

Using the contested divorce invoice provided above, here’s an example addendum that includes a retainer with a $5,000 trust account and a $2,000 minimum added to the bottom:

Flat Fee Invoice Template Example

Flat fee, or fixed fee, billing has become increasingly popular as it lets firms charge a set rate for repeatable projects and cases, such as contract drafting or a one-time consultation, while allowing clients to know their costs upfront. However, your invoice still needs to clearly communicate the value of the service provided by including:

- The fixed fee agreed upon at the beginning of the case

- The exact service rendered with a clear scope

- Any additional expenses, such as delivery services or travel

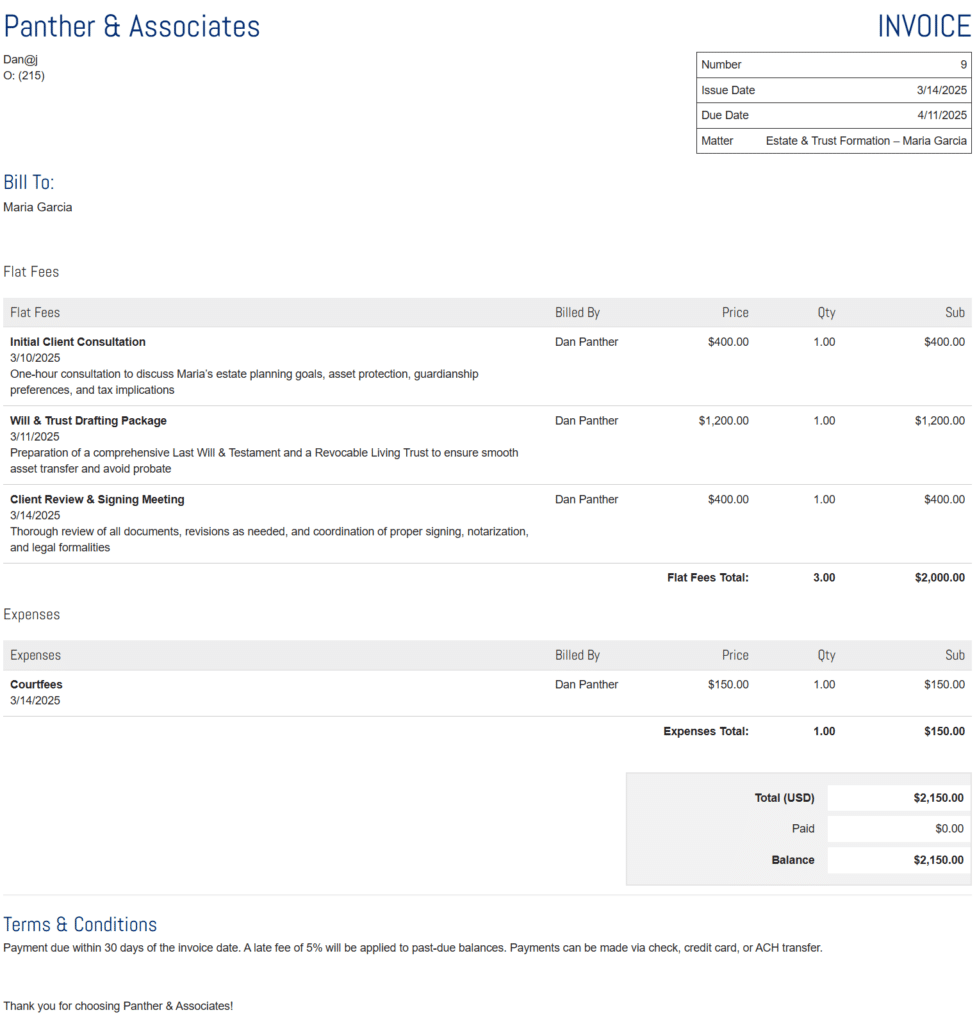

A flat fee invoice example where you charge $2,500 for a Will & Trust Drafting package:

Contingency Invoice Template Example

Law firms that charge a contingency fee are paid entirely based on whether a client wins their case, typically used in personal injury or malpractice matters. Since contingency fees are tied to case outcomes, invoices should be extra clear about how the payment was calculated. For firms using a contingency-based billing structure, your invoices should clearly outline:

- The case details and outcome

- The amount recovered

- The agreed-upon contingency percentage

- Any incurred expenses, such as court filing fees

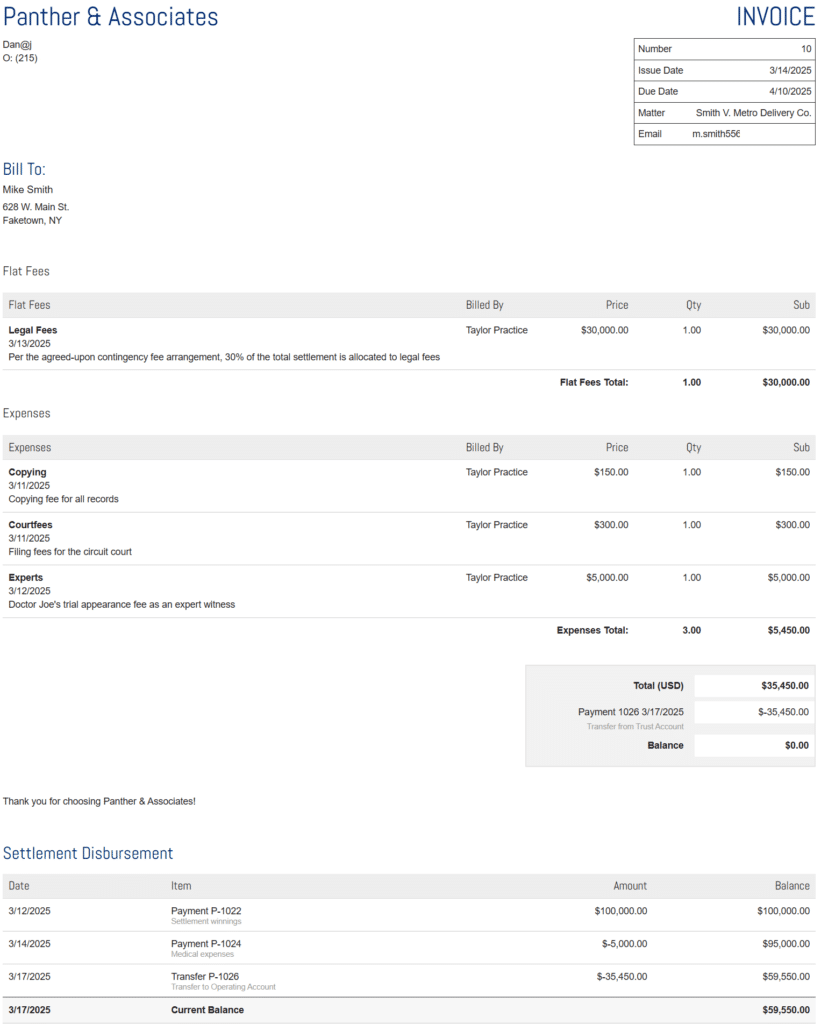

A contingency invoice example where a client wins a $100,000 settlement and your firm’s agreed-upon fee is 30%:

Free Download: Customizable Legal Invoice Template

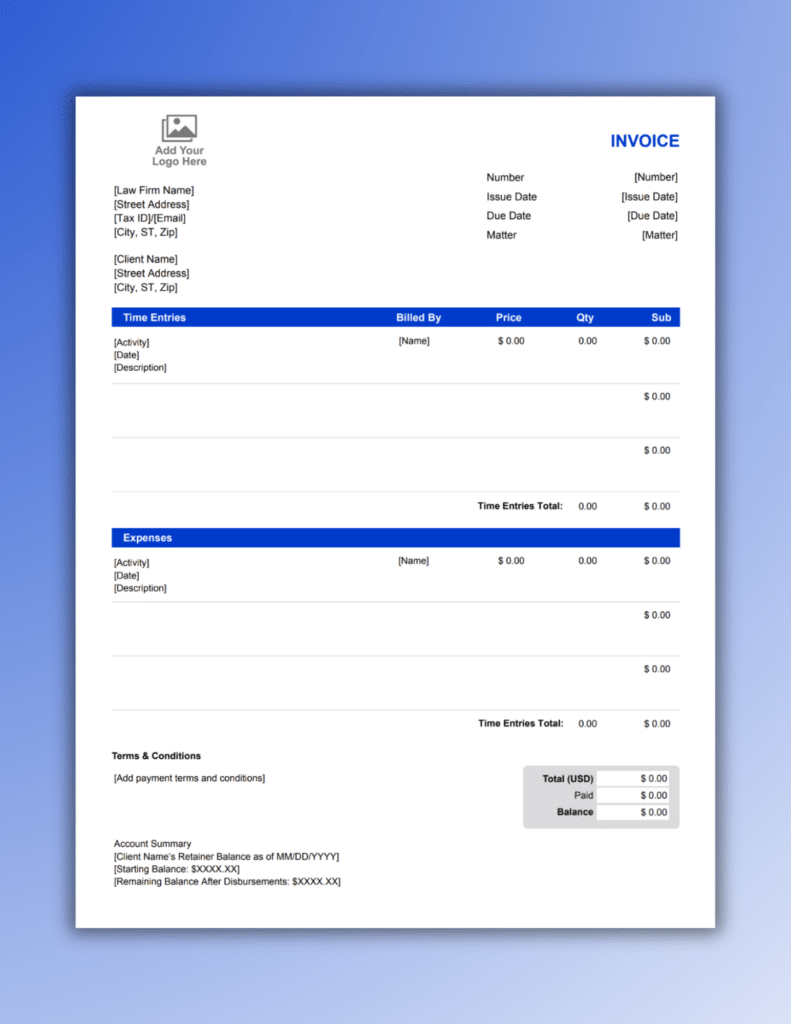

No matter how you bill clients, a well-structured invoice helps eliminate payment delays, prevent disputes, and maintain a professional image. To get you started, we’ve created a free legal invoice template that you can download and customize to use at your own practice.

Simply download and save the PDF, then start editing using the details we’ve discussed above.

What to Include in a Legal Invoice Template

While each invoice will vary based on your law firm’s practice area and billing structure, there are a few consistent components that need to be included in any professional invoice:

Law firm contact information

- Include your firm’s name, mailing/physical address, email, and phone number. Recommend also putting your logo at the top to tie it all together

Client information

- List the client’s full name, address, and contact information. If it’s a business, they may have a separate billing contact

Invoice information

- Be sure to include an invoice number, the date you send the invoice, and the payment due date. This information will help you keep track of each invoice while making it easy for clients to understand when they need to pay

An itemized list of services

- Depending on your billing arrangement, provide a clear, complete list of the services you performed, along with the billable rate and expenses incurred. Each item should include a detailed description of each task completed. This approach will make your billing process more transparent and lead to less client confusion

Total amount for all services

- The total amount the client will be charged for each line item on the invoice. Be sure to include any applicable taxes or discounts

Payment instructions

- A list of all the forms of payment your firm can accept (e.g. credit card, cash, check, bank transfer, etc.)

Terms and conditions

- Provide a clear description of the payment terms the client has agreed to. Including your late fee penalties, dispute resolution process, and any other related information on your firm’s policies

Best Practices for Legal Invoicing

To ensure timely payments and minimize disputes, follow these best practices:

- Be clear and detailed

Ambiguous invoices cause friction. Clearly describe services rendered, provide accurate time tracking, and avoid vague terms like “legal services rendered.” - Set transparent payment terms

Clearly state your due dates, late fees, and accepted payment methods upfront to manage client expectations. - Automate where possible

Manual invoicing is time-consuming. Legal billing software can automatically generate invoices, track payments, and send payment reminders to clients. - Offer multiple payment methods

Make it easy for clients to pay digitally by offering credit cards, ACH, and online bank transfers, in addition to cash and checks. The easier it is to pay, the faster that payment will come in. - Track unpaid invoices

More often than not, clients fail to complete a payment on time simply because they forgot. By providing consistent follow-up on overdue invoices with automated reminders, you’ll see your accounts receivable drop drastically.

How Legal Practice Management Software Automates Law Firm Invoice Templates

While legal invoice templates will save you time compared to building them yourself, they still require manual effort to fill out with the correct information and send every month. Using a complete legal billing system can eliminate the manual effort from your invoicing process.

Rather than tracking time and expenses for every client across disconnected files, all-in-one legal billing software, like PracticePanther, helps automate and streamline the process in one place by:

Capturing Billable Time Instantly

Log billable time as you work—whether in meetings, drafting documents, or responding to emails—so you never miss a minute. With one click, your time entries convert into an invoice, ensuring accurate billing every time.

Generating Professional Invoices in Seconds

Create and implement unlimited, customizable invoice templates easily. Automatically insert detailed line items, apply different billing structures, and brand invoices with your firm’s logo and colors, ensuring a polished, clear invoice consistently without extra work.

Get Paid Faster with Built-In Online Payments

Allow clients to pay instantly via credit card or ACH directly from their invoice. Automated reminders nudge clients before payments are overdue or retainers are depleted, and you can set up payment plans to make payments more manageable.

By implementing the right invoicing structure and best practices, you can streamline your billing process and get paid faster. If you’re looking for an even more seamless way to generate and manage invoices, explore how PracticePanther can automate and optimize your firm’s legal billing workflows.