Billing for your hard work and collecting the well-earned payment for your services should be simple and, let’s be honest, incredibly satisfying. In a perfect world, your firm does great work, you send an invoice, and you get paid. In reality, it’s rarely that easy. Instead, attorneys and legal staff find themselves neck-deep in draining administrative tasks:

- Manually tracking billable hours across multiple matters

- Chasing down clients for overdue payments

- Managing cash flow disruptions that make financial planning unpredictable

As a busy law firm practitioner, inefficient billing and payment processing isn’t just an inconvenience—it can pose a hostile threat to the firm’s bottom line and cash flow. The longer it takes to get paid, the harder it becomes to keep operations running smoothly, pay staff on time, and invest in the firm’s future growth.

So what’s the root problem? Many firms rely on outdated or rigid billing processes that don’t fit the way they actually work.

Even firms that have invested in legal billing software often struggle with workflows that are either too complex, too limited, or simply not built for the realities of modern law practices.

Is there any hope? Absolutely. With the right approach, you – yes, you – can build a legal billing and payments collection workflow that works FOR your firm—not against it. In this guide, we’ll cover the best practices for modern legal billing and show you how easy it is to create your own workflow that fits your firm like a glove, boosts cash flow, and delivers that satisfaction you’re looking for.

Best Practices for Modernizing Your Billing & Payment Processes

When it comes to getting paid faster, it’s not about working harder; it’s about working smarter. It seems obvious, but if your firm still relies on sporadic time tracking, manual invoicing, or limited payment options, you’re simply leaving money on the table.

Here are 5 best practices to modernize your billing and payment processing workflows:

1. Track Billable Time in Real-Time

If your attorneys or staff are waiting until the end of the day (or worse, the end of the week) to log their time, your firm is losing a significant amount of money. The ABA even put out a study that backed this concept up with real numbers. Proving that the longer firms wait to log their time, the more revenue they lose:

- Entering time at the end of the day = 10% loss of your billable hours, on average

- Waiting until the next day? That time slippage increases to around 25%

- The end of the week? Firms can lose up to 50% of their billable time

To seal that leaky billable time bucket, implement a legal time-tracking system that allows attorneys and staff to record their hours in real-time, whether at their desks or on the go. The best approach is to integrate time tracking directly into daily workflows, making it easy to start and stop timers, log entries under specific matters, and ensure no billable second falls through the cracks.

2. Make it Easy for Clients to Understand Your Invoices

A vague or poorly formatted invoice is one of the fastest ways to create friction between law firms and their clients. Clients who are confused about what they’re being charged for are more likely to dispute or delay payment.

Consider this: Invoices are one of the most direct mediums to reassure your client that you’re delivering on the value they were initially sold. With that thought in mind, to ensure clarity and professionalism, your invoices should:

- Be structured in an easy-to-read format

- Clearly detail each billable task, including time spent and descriptions

- Provide a summary of total fees, previous payments, and outstanding balances

- Make it easy for clients to pay directly from the invoice

By quickly entering detailed task descriptions, your firm can create clearer, more transparent invoices that highlight the true value of your work. This not only helps clients understand what they’re paying for but also speeds up the payment collection and strengthens trust—a real win-win situation.

3. Offer Multiple Ways for Clients to Pay

Today, the average person expects to have the ability to pay for goods and services in multiple ways wherever they go. People feel instantly frustrated when they find out a business only accepts cash or checks, and legal clients are no exception to this reaction.

A study conducted by the Federal Reserve found that 75% of consumers prefer digital payments, such as credit cards or ACH transfers, while cash and paper checks are becoming increasingly obsolete (19%)

This trend is especially evident, albeit unsurprisingly, across age ranges. The same study found that cash and paper checks account for less than 14% of payment methods used by consumers under 55.

With the upcoming wave of potential clients predominantly preferring digital flexibility when paying for services, offering online payment processing is no longer simply a convenience; it’s now a business necessity.

To attract new clients and reduce the friction in their payment collection process, firms must modernize by:

- Accepting credit cards, debit cards, ACH, and more digital payment options

- Ensure online payment portals are secure and easy to use

- Provide mobile-friendly options for clients who prefer to pay from their phone

4. Offer Payment Plans to Avoid Chasing Clients

If providing multiple options for HOW clients pay is a recipe for success, then combining that strategy with flexibility around WHEN clients pay creates a delicious multi-course meal clients will leave 5-star reviews about.

More often than not, clients seek legal help during financial hardship, making it difficult for them to pay upfront. This can lead to delays or missed payments. However, research has shown that firms offering structured payment plans experience:

- 32% higher payment collection rates

- 49% more revenue per lawyer per month

- 80% improvement in client satisfaction

So what does an effective payment plan actually entail?

- Set clear expectations with clients upfront about payment schedules—beginning during the initial intake process but reemphasizing throughout the case

- Offering automated recurring payments to minimize administrative work

- Structuring plans in a way that ensures consistent cash flow while remaining manageable for clients

By making your legal services more financially accessible, your firm can reduce most outstanding balances and create a stronger relationship with your clients overall.

5. Help Forgetful Clients with Automated Payment Reminders

Let’s face it: Most past-due clients aren’t intentionally avoiding payment—they simply forget. In fact, according to a recent study, 29% of past-due clients simply forgot to submit their payments.

Instead of relying on staff to follow up manually, here are the best ways to prevent overdue payments:

- Set up automated email and text reminders at strategic intervals (i.e., every 15 days or at the end of every month)

- Include a direct payment link in every reminder for quick and easy access

- Personalize reminders with client names and invoice details for improved engagement

Automated reminders eliminate the awkward phone calls you and your staff hate making while increasing the likelihood of prompt payments.

6. Provide Clear, Transparent Payment Policies from Day One

One of the best ways to ensure clients pay on time is to build trust from the start by being upfront about your billing policies. Whether you bill hourly by attorney, charge a flat fee per project, or work on a contingency basis, make sure your rates are clearly outlined during the initial consultation in a way that’s easy to understand.

Then, reinforce this conversation in your Letter of Engagement, detailing payment terms, due dates, and any fees for late payments. By setting clear expectations in writing, you give clients confidence in the agreement and establish a strong foundation of trust from day one.

How to Customize Your Firm’s Legal Billing & Payment Workflow with PracticePanther

With the blueprint for modernizing your firm’s billing and payment processes in hand, how do you actually put these best practices in action without overhauling your entire existing system?

With a 100% customizable practice management platform like PracticePanther, you can easily plug these modern strategies into the billing and payment processing workflow your firm is already familiar with. Whether you want to add real-time time tracking, custom invoicing, flexible payment options, or automated reminders, PracticePanther adapts to your firm’s unique needs rather than trying to fit a square peg into a round hole.

Here’s how easy it is to create a fully custom legal billing and payment processing workflow with PracticePanther, along with a real-world example use case:

Track Your Time in Real Time, From Anywhere

You work hard for your clients, so as we discussed above, don’t lose billable hours by waiting a day or week to log your time. With PracticePanther, you can effortlessly capture every billable minute as it happens, ensuring accuracy, maximizing revenue, and eliminating time leakage. Countless firms utilize PracticePanther to simplify time-tracking by:

- Tracking time from any device with the cloud-based platform that lets them start, stop, and log billable hours in the office, court, or on the go.

- Uncovering lost billable time instantly with the MoneyFinder feature, which helps them identify unbilled activities in one click.

- Linking time entries directly to a matter so every billable task, email, or phone call is categorized correctly and easily referenced on invoices.

- Customizing time tracking preferences to fit your firm’s workflow, whether they bill by the hour, task, or combination of both

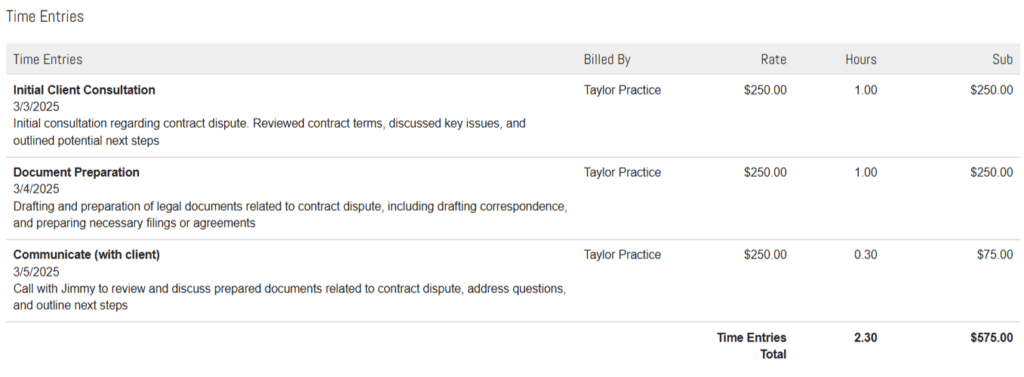

PracticePanther in Action

You’re starting a client call to cover key documents drafted for Jimmy Smith’s contract dispute case. Rather than manually recalling your work later, you start a timer from any device, ensuring every minute is accurately tracked.

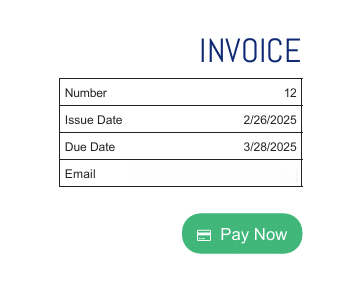

Create & Send Custom Branded Invoice Templates Any Way Clients Prefer

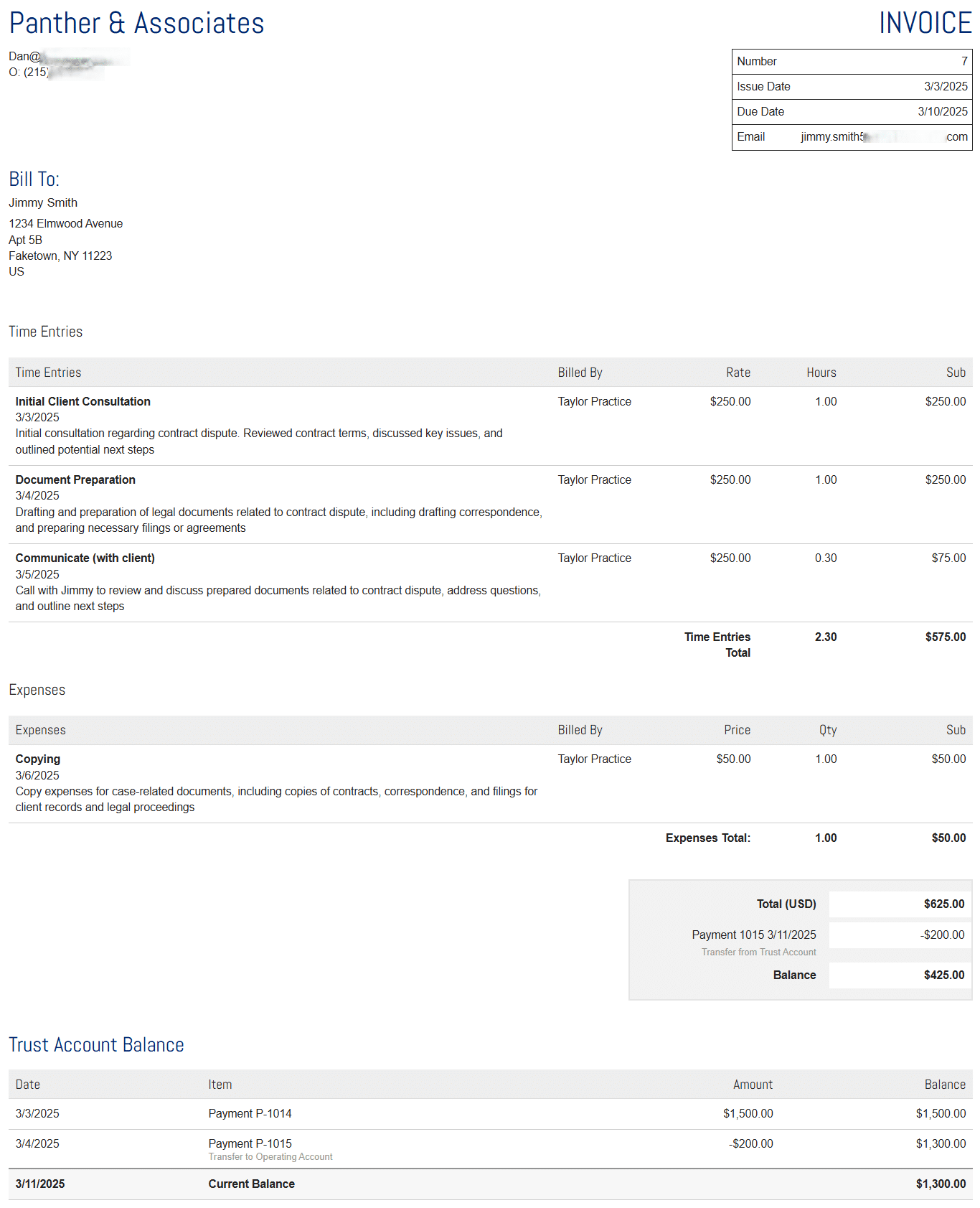

A well-structured, professional invoice not only reinforces your firm’s brand but also makes it easier for clients to understand their charges. With PracticePanther, you can create and send custom invoices tailored to your firm’s needs while giving your clients clear insight into the work you’ve done for them. Law firms generate and send custom invoices instantly by:

- Building custom-branded invoices with their firm’s logo, colors, and preferred layout to ensure professionalism and clarity

- Tailoring invoice templates to different case types so they can instantly generate invoices that fit each client’s billing structure—no manual adjustments needed

- Sending invoices however their client prefers, either via email, a secure client portal, or even snail mail

- Forgoing tedious data entry by automatically pulling in billable hours, expenses, and applicable taxes, ensuring accuracy and saving your firm valuable time

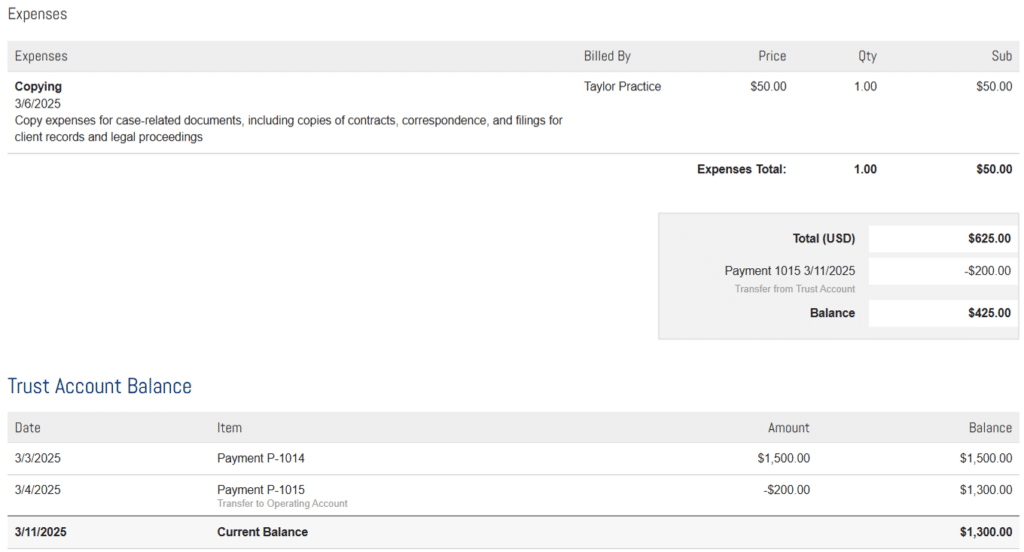

PracticePanther in Action

With just one click, apply the tracked time for Jimmy Smith’s contract dispute work to your invoice template and hit send in seconds—no manual entry or formatting needed.

Offer Flexible Payment Methods & Plans

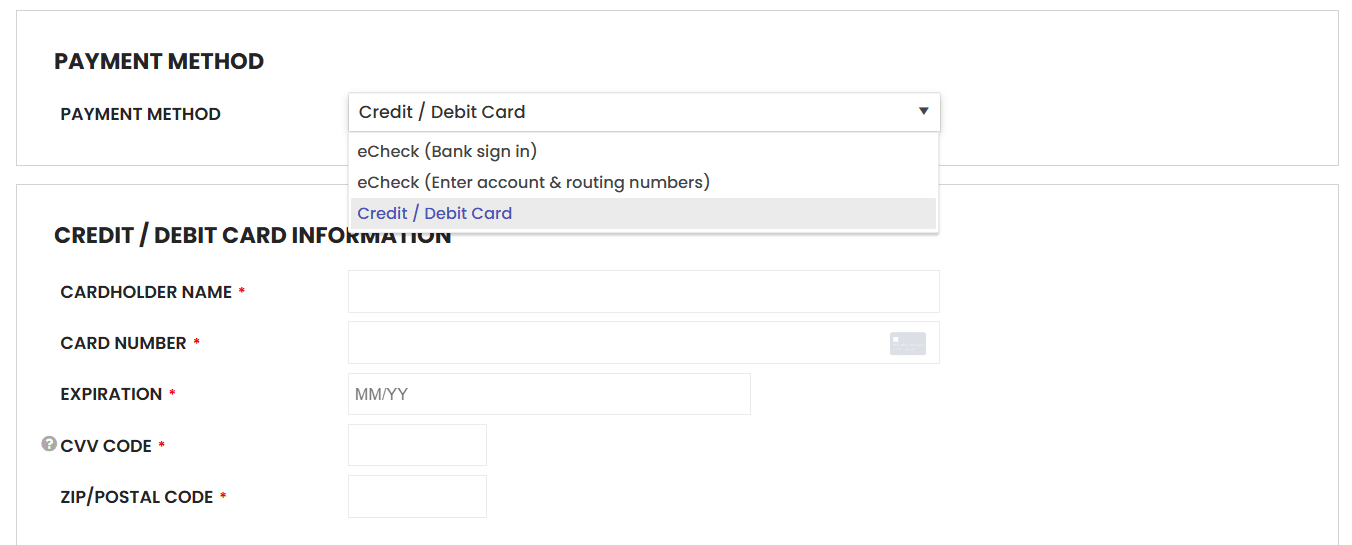

Every client has different financial needs, and offering multiple payment options ensures a smoother billing experience while improving cash flow for your firm. With PracticePanther’s built-in payment processor, PantherPayments, firms are:

- Accepting a variety of payment methods — including credit cards, debit cards, ACH, eCheck, and trust transfers — while staying compliant with legal industry standards

- Providing secure, convenient payment links so clients can pay from any device with just a few clicks, reducing the friction in the payment process

PracticePanther in Action

Jimmy Smith prefers to pay with a credit card. With PracticePanther, you can accept his payment instantly.

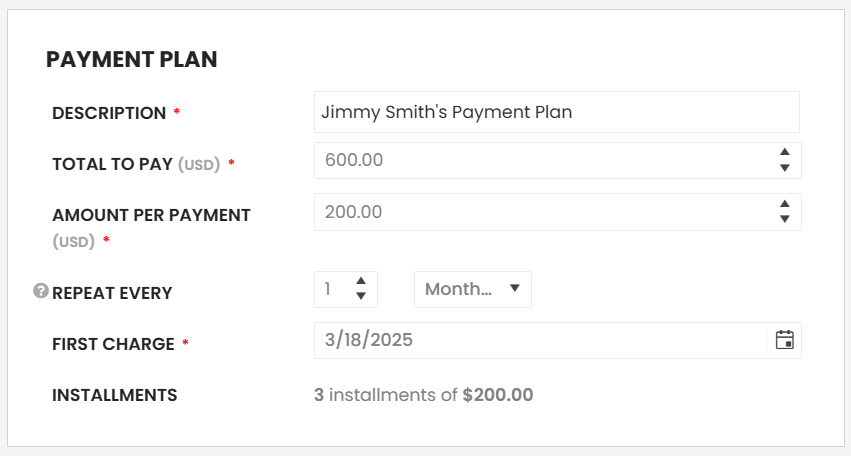

Additionally, since every client has a different financial situation and preference, PracticePanther makes it easy to create flexible structured payment plans.

PracticePanther in Action

Jimmy Smith has money tied up in investments and prefers to pay in scheduled installments. You can easily set up a custom payment plan that spreads out his payment due dates over more manageable intervals.

Send Automated Reminders to Complete Payments

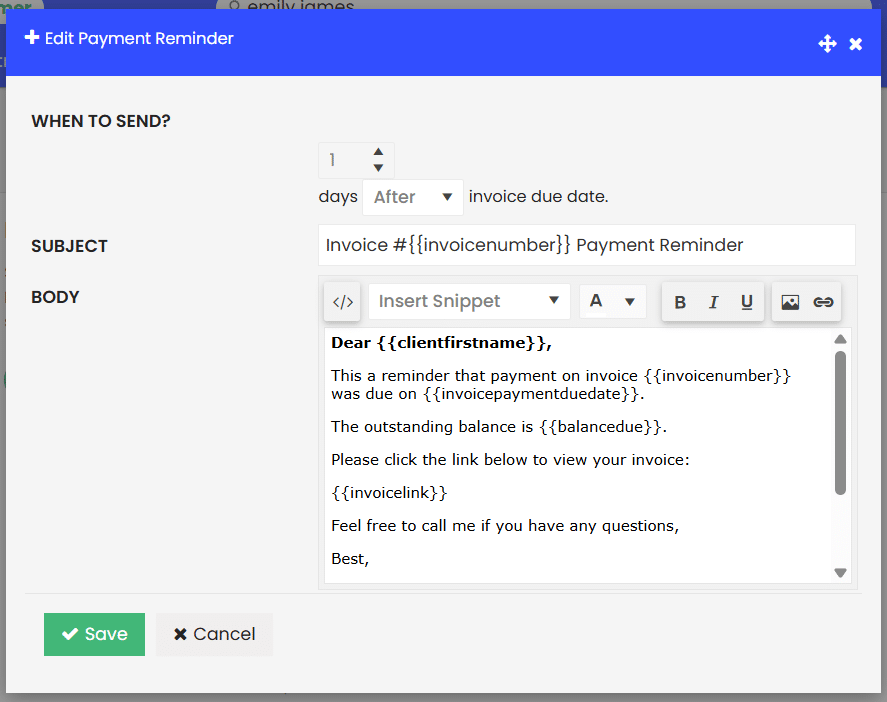

Help forgetful clients complete payments with automated reminders to their email or text messages with a direct payment link. Set up rules that fit your firm’s ideal follow-up cadence to reduce overdue payments and increase cash flow.

Keeping up with invoice follow-ups can be time-consuming, but automation can help forgetful clients stay on track with their payments. With PracticePanther :

- Set up automated payment reminders via email or text so clients never miss a due date and you spend less time chasing down payments

- Schedule recurring billing for clients on subscription-based or installment payment plans to maintain consistent cash flow

- Customize a follow-up cadence to match your firm’s ideal communication style. Keeping clients informed while maintaining a professional relationship

PracticePanther in Action

Jimmy Smith tends to forget payments when they’re spaced out. You set up automated reminders with the custom secure payment link to his invoice to complete the payment, ensuring he stays on top of paying the money you’re owed.

Build a Billing & Payment Workflow That Fits Your Firm

With PracticePanther, your firm isn’t locked into rigid billing structures or outdated payment processes. Instead, you have a full suite of customizable features that make it simple to create a billing workflow that actually works for your firm and your clients.

Want to see it in action for yourself? Watch our quick walkthrough video below to see how our billing and payment features come together to streamline your firm’s billing process and get you paid faster.