While the billable hour has been the long-time standard for law firm billing, your firm may attract more clients by offering alternative fee arrangements (AFAs). By providing clients with options for how they’ll pay you, you position your firm as affordable, accessible, and understanding of a wide range of financial situations.

High attorney’s fees could deter clients from seeking legal guidance or make them work with a low-cost lawyer who can’t offer the same benefits as your firm. You can set your firm apart from competitors by making flexible law firm pricing agreements one of your selling points.

In this guide, we’ll discuss why law firms may want to consider adopting an alternative fee arrangement pricing strategy.

What Are Alternative Fee Arrangements (AFAs)?

Alternative fee arrangements are competitive pricing options for legal services that go beyond traditional hourly billing. Historically, under the billable hour model, law firms charge clients per hour of work they put into completing a case, which requires tracking every employee’s time spent on a project. There are several drawbacks to exclusively offering the hourly billing fee model, including the following:

- Clients can’t budget for attorney’s fees, as they don’t know how many hours your firm will spend on their case.

- Your clients could assume your firm is spending longer than necessary on their case for profit.

- It can quickly become challenging to accurately track the billable time you and your team dedicate to a case.

Hourly billing isn’t obsolete, but adding alternative fee structure options into your law firm billing process can make the entire process easier in a few key ways.

Provide an Accurate Breakdown of the Services Your Firm Performed

Regardless of the fee arrangement clients agree to, they’ll want to know what your firm is charging them. When you only charge by the hour, it’s easy to forget to track your time or record what you devoted your efforts to.

By offering AFAs, your firm can be more efficient and show clients your cost structure and what they are paying for. You will also gain a clearer understanding of what your clients expect to pay for your legal services.

Collect Timely Payments From Legal Clients

It would be ideal for clients to pay your firm as soon as possible after their case is settled, but this isn’t always feasible. You might give clients a payment deadline, but your firm might not see the money you need for a while if they don’t have the money to pay you.

In the worst-case scenarios, you might need to turn the client’s account to a debt collection agency to ensure your firm receives the payment you need. It isn’t easy to demand expensive fees from clients.

If your clients sign on for a fee arrangement they can afford, it may be less challenging for your firm to get the money they owe you for your services. Letting clients use online payment methods is another strategy to consider when setting up legal fee arrangements.

Ensure Clients Are Satisfied With Your Law Firm

Giving clients the power to choose how they pay you helps ensure client satisfaction.

Alternative fee arrangements are also attractive because you can gain more clients that may not have been able to afford legal fees otherwise.

Should My Law Firm Consider Alternative Fee Arrangements?

Alternative fee arrangements are beneficial to clients and your firm. If your firm isn’t getting cases or your leads aren’t signing on with you, it may be time to consider how offering AFAs can help minimize intake friction.

Benefits of Alternative Fee Arrangements

Some of the benefits of offering alternative fee arrangements include the following:

Your Firm Provides a Client-Focused Environment

Most people cannot afford to spend thousands of dollars at once. If you ask customers to pay by the hour, they might assume they can’t afford a lawyer and won’t pursue their case. AFAs allow clients to predict how much it will cost to hire a legal professional and decide if working with your firm is the right choice.

In the current economic market, many families are concerned with growing savings and maintaining a consistent cash flow. AFAs let them decide how much money they will give your firm at once. Plus, giving clients flexible ways to pay makes collecting payments more convenient.

It Can Improve Law Firm Billing Workflows

Alternative fee arrangements provide price transparency from the beginning of the attorney-client relationship. This allows you to set clear client expectations right away, which may prevent you from explaining why you’re charging clients for certain services later.

AFAs may also make legal professionals more motivated to achieve successful results in every case. Rather than paying for all the work that goes into the case-building process, clients pay for the outcome you secure for them.

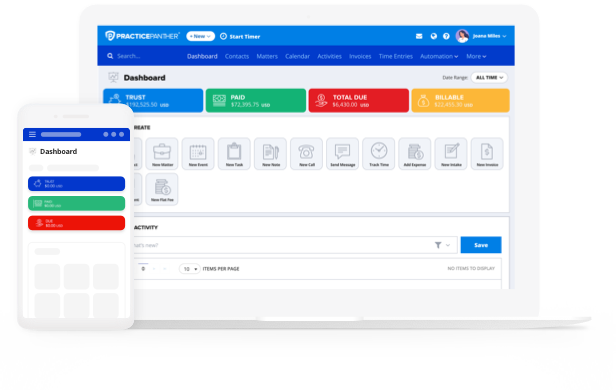

Using practice management software in combination with AFAs can help to further streamline your billing workflow. Instead of handling administrative tasks like document management, calendaring, and sending payment requests, you can use legal software to handle this for you. Plus, legal software allows you to pull reports and analyze your firm’s cash flow. When you know what’s working and what isn’t, you can cut back on non-billable hours.

In the long run, offering AFAs and using legal software can prevent burnout and help your firm become more focused on results.

Streamline (And Possibly Improve) Law Firm Collections

Alternative fee arrangements for law firms offer financial benefits as well. You’re more likely to get paid if clients know exactly what they’re paying for, how much they owe, and when they owe it.

In most cases, clients only avoid paying your firm because they can’t afford it. Payment plans can increase law firm cash flow because you’ll be earning money consistently by asking for it over time rather than all at once.

It’s also more likely your firm will get paid faster when you ask clients to give you smaller sums of money. For instance, they can decide to give you a certain amount per paycheck they earn, which improves your chances of getting paid on time.

Offering flexible payment plans is a win-win situation. Clients can pay you when they have the funds to do so, and your firm can maintain revenue. Even if your firm successfully settles a client’s case, they’ll consider affordability before recommending your firm to people they know. Clients with lower incomes deserve to have a legal advocate on their side. By offering AFAs, you position your firm as one that will help clients with litigation costs despite their financial situation.

Common Types of Legal Fee Billing That Law Firms Use

Your firm may not implement every type of alternative fee arrangement, but considering a few of the following common types of AFAs may make your firm more approachable to prospective clients:

Payment Plans

Payment plans let your clients pay you in installments rather than up front. A common reason clients avoid paying their bills is they can’t afford to front thousands of dollars at once. Letting them pay you in smaller sums over time can ensure your firm gets paid for the work you did.

One downside to offering payment plans is that your firm might be waiting months or years to receive payment from a single client. However, making your firm affordable could lead to client referrals and valuable testimonials.

Plus, it’s better to receive your payments over time instead of not getting paid at all.

Contingency Billing

Contingency fees are beneficial when clients can’t afford to pay a retainer to hire a lawyer. Your firm may decide to offer a contingency fee arrangement in complex personal injury cases, for example. This AFA motivates your team to secure a successful case outcome for your clients because you won’t receive payment unless the case is won.

A contingency fee structure also allows the client to avoid paying you out-of-pocket. This is an appealing selling point for clients who know they need a lawyer but cannot afford to pay upfront.

Your firm must be aware of state rules before allowing clients to sign on for a contingency fee agreement. This type of AFA can’t apply to certain cases.

Flat-Fee Billing/Fixed-Fee Billing

Clients can pay a pre-set fee to have your firm handle a specific legal task. When a client doesn’t need ongoing help, allowing them to pay a flat fee saves your firm time and resources.

With flat fee or fixed-fee billing, your clients feel in control of their purchase, and they’ll appreciate your firm’s pricing transparency. This AFA doesn’t work for every type of case, however. Your firm can charge a flat fee for clear-cut services, such as drafting a client’s will, but this fee arrangement probably won’t work for ongoing cases.

Capped Fees

With a capped fee pricing model, your firm can be up front about the agreed-upon final cost of your client’s case. You can still set an hourly fee for your services, but you and your client can set an agreement determining the maximum cost you’ll charge for handling their legal matter.

Capped fees allow clients to budget for the cost of hiring a lawyer. They’ll know from the start whether they can afford your services, saving your firm time and energy instead of hunting them down for payment.

The biggest pitfall to this type of alternative fee arrangement is that it’s tricky to predict how much a client’s case will cost. Your firm should generally only offer a capped fee arrangement if you’re confident in the total cost of handling a legal matter. If not, you could risk meeting the cap and working to complete the case with your money.

Blended Fees

If your firm charges blended fees, you agree to charge clients an average hourly billable rate regardless of which attorney handles their case. For instance, your new attorneys, partners, and senior partners might charge different hourly rates depending on their years of experience. With the blended fee arrangement, your firm would take the average of these three hourly rates and charge clients that amount.

A blended rate can save clients money when a senior partner completes most of their caseload, as the blended fee would be less expensive than the senior partner’s hourly rate. However, if a new attorney manages their case, they may be paying more than they would have if they paid the new attorney by the hour.

Success or Performance Incentives

A success incentive means a client will pay you a predetermined amount regardless of whether you win or lose their case. However, if you win, you may receive more money because of your success.

This alternative fee arrangement can be motivating for attorneys. It also helps ensure clients are satisfied with how a legal professional handles their case. They can also avoid feeling like they overpaid if you lose their case.

Unbundled Legal Services

With unbundled legal services, clients have the power to choose the specific tasks they want your firm to handle. They may decide to handle the rest of their case on their own. The client pays you for the legal services they need while taking on some of the work by themselves.

Unbundled legal services give clients affordable access to help since they’ll only ask your firm to handle complex case tasks. Plus, it allows clients to avoid paying for services they know they can handle on their own.

Sliding Scale Fees

Factors like a client’s family size or income may impact their ability to afford your legal services. With sliding scale fees, your clients can pay you lower hourly rates or flat fees depending on their financial situation. This way, affordability will not deter clients from choosing your law firm.

Although your firm may not make as much money by charging sliding scale fees, you could benefit from return clients or referrals. Plus, you give clients access to legal guidance who wouldn’t otherwise be able to afford the traditional cost.

Subscriptions

Clients can subscribe to a legal service plan and pay a recurring monthly fee. Your firm can customize the client’s monthly price to ensure you’re getting paid fairly for the services you rendered.

Subscription pricing models generally work best for clients who need ongoing services rather than help with one case. If your firm handles business law matters, for example, a client might pay you a subscription fee for routine document review.

Offering this alternative fee arrangement allows you to build strong attorney-client relationships. Also, you can predict how much time and energy you must devote to the client’s matter each month.

How to Offer Alternative Fee Arrangements

It may seem complicated to set an alternative fee agreement for every client that hires your firm, especially if you’re used to exclusively charging an hourly rate. When you discuss AFAs with your clients, consider the following:

Use Clear Communication

Being transparent about litigation costs from the start will leave a good impression on your clients. Nobody appreciates surprise fees, so ensuring clients know what to expect positions you as an honest and trustworthy client-centered law firm.

Customize Alternative Fee Arrangements for Each Client

Every client’s financial situation is different. Giving your customers the power to choose how and when they’ll pay you can ease financial worries about their legal fee arrangement.

Be Transparent Throughout the Entire Payment Process

AFAs only work if the attorney and the client know how the payment process will look. Communicate with clients about when their bills are due and how much they owe you. This may help you avoid any conflict or confusion when it’s time to charge your customers.

Use Reliable Legal Billing Software With a Built-In Payment Processor

Streamline the billing processing using PracticePanther’s law practice management software. Instead of spending your time requesting payments, you can get paid faster and improve your firm’s collection rates.

You won’t have to ask clients to create an account with a third-party payment processor, either. With PracticePanther, you can send custom payment links to your clients and keep all your legal billing in one place.

A Recap on Alternative Fee Arrangements for Law Firms

Alternative fee arrangements for law firms benefit clients and lawyers. Clients can sign on for a payment structure they can afford, and your firm can get paid faster. Allowing clients to agree on how and when they’ll pay you makes it more likely that your firm will receive the money you need.

Gone are the days of repeatedly demanding payments and sending clients to a debt collection agency. Lawyer payment plans make your firm more affordable and appealing to a wider group of prospective clients.

You can choose which type of payment plans your firm will offer depending on the cases you handle. For example, personal injury law firms might decide to charge on a contingency fee basis. Meanwhile, sliding scale fees, unbundled legal services, and blended fees might be strong selling points for family lawyers.

Adding alternative fee arrangements to your hourly billing structure is a solid option for firms that aim to help clients in any financial situation. PracticePanther’s legal practice management software can help you make the billing process less stressful, saving you time and getting you paid.