Do you spend countless hours manually tracking billable hours, invoicing clients, and processing payments every month? You’re not the only lawyer who’s stuck in the day-to-day minutia of running their law firm. Imagine instead that you’re using those hours to strategize and grow your business.

By automating your billing tasks, you’ll not only leave the office in time for dinner with your family but trust that all your billable hours and payments are accounted for, making tax time a breeze.

In this guide to legal billing, you’ll learn about:

- Client expectations in today’s legal marketplace

- Types of legal billing

- Formatting invoices (with examples!)

- Writing your firm’s legal billing guidelines

- Choosing the right legal billing system for your firm

- Setting up a billing system that actually works

- LEDES billing & why some firms use it

- Managing your law firm’s accounting to avoid audits

- Getting paid faster by automating your invoicing

- Equipping your firm to accept online payments

What Clients Expect In Today’s Legal Marketplace

You know better than anyone else: Competition is fierce in the legal services market. And the glut of choices available to your potential clients influences their expectations.

Clients today demand exceptional customer service. To compete in the current market, you need to listen to your clients, respond quickly to their calls and emails, offer solutions to their problems, and set their minds at ease. You need to go beyond the cookie-cutter approach that so many law firms provide.

Why It’s Important To Get Your Legal Billing Strategy Correct

A user-friendly billing system improves the client’s experience by providing the communication, service, and transparency they expect.

Your firm’s legal billing strategy should include a system for tracking expenses and billable hours so that invoices are accurate, timely, and easy to understand. It should clearly communicate your law firm’s pricing model and provide clients with safe and easy payment options.

An effective legal billing strategy also keeps your firm’s finances organized. Issuing invoices and keeping track of payments is time you spend away from your law firm’s primary focus: your clients.

But without a billing strategy that streamlines your finances and offers accurate recordkeeping, you risk losing clients and profits. A poor billing system causes inefficiencies, losses, and headaches that can stifle your law firm’s growth and damage its reputation.

Keep reading to understand better why creating an efficient system is worth your time and how you can implement one at your firm.

What Are The Different Types Of Legal Billing?

Common legal billing models include:

- Hourly rates

- Flat fees

- Contingency fees

- And retainer fees

The legal billing system that’s right for your firm depends on the types of cases you handle and your firm’s preferences.

What Are Hourly Rates?

The hourly rate a law firm charges depends on the type of case, the firm’s market, and other factors we’ll explore below.

When you’re charging clients hourly, you’re responsible for documenting your work and the amount of time you spent on the client’s case. You can account for time spent sending quick emails or making short phone calls by charging partial hours.

It’s best to track your hours as you work instead of at the end of the day or week; otherwise, you may fail to account for all the time you spent working on a client’s case. Thankfully, practice management software like PracticePanther allow you to track billable hours as you go.

What Are The Factors That Determine Hourly Rates?

Your law firm’s billing rates should reflect the value of your time, experience, and expertise. More specifically, factors affecting your hourly rate include:

- Practice Area: Lawyers in different practice areas usually set different hourly rates. For example, corporate law and intellectual property law are two of the higher-paying practice areas in the legal sector.

- Years of experience: If you’re a seasoned attorney with 20 years of experience, you can charge a higher rate than an associate just out of law school.

- Reputation: You can consider charging higher rates if your firm enjoys a stellar reputation in the market.

- Market rate: Also, consider your firm’s location. Research what other firms are charging to establish a baseline fee expectation.

You can also check with your local bar association for data on hourly rates in your area. Additionally, many state Rules of Professional Conduct also outline the various factors that should influence what you charge. For example, the Minnesota Rule of Professional Conduct 1.5 lists numerous “factors to be considered in determining the reasonableness of a fee,” like time limitations imposed by the client, the time and labor required, the results obtained, and many others.

What Is Flat Fee Billing?

With flat fee billing, a law firm charges the client a fixed cost to represent them or complete specific legal services.

One of the main benefits of flat fee billing is that clients typically pay in advance. Fees are then deposited into the firm’s trust account. Once the case ends, the payments are transferred into the firm’s operating account.

Your firm might charge flat fees for cases where the volume of work, operation costs, and case timeline are predictable and relatively fixed. For example, many firms charge flat fees to create a simple will or complete an uncontested divorce.

Before choosing flat fee billing, carefully consider the unexpected delays or extra time you may have to dedicate to a case if complications arise. Charging a flat fee for a simple uncontested divorce may require you to spend additional hours on the case if the divorce unexpectedly becomes contested. To prevent having to work these hours pro bono, you can include supplemental hourly rates or an additional flat rate for unexpected disruptions to the timeline or nature of the case.

What Is A Retainer Fee?

A retainer fee is an advanced payment for future legal services. You agree to consult your client on legal matters for a specified time and then take your fees from the retainer as you work their case.

For example, you may charge your client a $1,000 retainer fee. You then draw your hourly rate from the retainer until it has been exhausted.

At that time, you can either keep the retainer fee agreement or change to another billing option. You’ll need to deposit retainer fees in a trust account, so make sure your payment processor enables you to do so. You can then transfer your fees to your operating account as you render services.

A system like PracticePanther can track the hours you spend on each case and produce detailed invoices so clients can see how you’re using the retainer.

What Is Contingency Pricing?

Contingency pricing deducts your fee from the client’s award or settlement. Not all cases qualify for contingency pricing, but this billing model is especially common in personal injury, medical malpractice, workers’ compensation, Social Security, and veterans disability cases.

Several factors can impact the percentage of a contingency fee, including:

- The complexity of the case

- Litigation costs

- The expense of retaining experts

Personal injury and medical malpractice contingency fees are between 33 and 40%. The fee for Social Security disability cases is typically 25% of the claimant’s back pay but no more than $7,200. Lawyers who handle veterans disability claims usually get around 20 to 30% of back pay. State laws typically dictate contingency fees for workers’ compensation cases.

Contingency pricing tells your potential client you’re confident about winning their case.

What Is Capped Fee Billing?

With capped fee billing, you’d charge hourly for services but place a ceiling on the total cost.

This billing model allows clients to budget for legal services, knowing the total fees will not exceed the cap. It works best when you can reasonably predict the workload and expenses associated with a case.

Otherwise, you’ll incur the cost of exceeding the cap, which will eat into your profits. You’ll want to track your billable hours and send an invoice documenting your firm’s time and tasks.

Transparency like this can increase your client’s confidence and trust in your firm.

What Is Sliding Fee Billing?

Sliding fee billing considers a client’s household income and ability to pay. For example, you can establish different hourly rates and flat fees based on where your client falls in relation to the Federal Poverty Level.

A sliding fee billing model can provide quality legal services to under-represented clients at an affordable rate. In addition, it gives more clients access to the justice system and expands your client base.

If your firm decides to use a sliding fee, it should clearly define how the pricing model works in the client agreement.

What Is Unbundled Billing?

You can use unbundled billing (also known as “limited scope representation”) to charge for a specific task instead of the full scope of the case. For example, clients pay you a flat fee to prepare their legal documents or an hourly rate to conduct legal research.

The client doesn’t require full legal representation but benefits from hiring you to draft important documents or research their case.

What Is a Subscription Model?

A subscription model charges clients a recurring monthly rate for legal services. This model works well for small business owners who need occasional or regular legal counsel.

This pricing strategy helps build relationships with clients who wish to engage with their attorney on a long-term basis and provides the firm with predictable monthly income. The funds go to the firm’s trust account, and the firm moves them to their operating account at the end of the month. The firm then charges the client each month to replenish the account.

If you choose a subscription model, be sure to invest in technology like PracticePanther which makes it effortless to request and track payments every month.

What Are Payment Plans?

A payment plan model allows clients to pay for legal services in installments. These plans work for clients who can’t afford hourly or flat rates in full.

Like with any contract, draft a payment agreement beforehand so the client can review the terms. Make sure you clearly communicate whether late payments attract penalties or if the client will incur additional fees by paying in installments.

How To Choose The Best Law Firm Pricing Model For Your Practice

When deciding on a pricing model, choose one that:

- Meets your firm’s operating expenses

- Helps you reach financial benchmarks

- Works for your clients

First, the type of case has a significant impact on your pricing model. While a flat fee may work for a predictable traffic ticket case, a complex criminal defense case may warrant an hourly rate because of its unpredictability.

The client’s needs can also influence your decision:

- A small business in need of intermittent legal services may prefer a subscription model.

- A large corporation may prefer to pay a retainer.

- Low-income clients may prefer sliding-scale payments and payment plans.

Your value should dictate the pricing model you choose, too. For example, charging a flat fee when it is hard to predict the case’s difficulty, time commitment, and cost devalues your services. In such cases, an hourly rate may be appropriate.

Consider the capacity of each pricing model to provide reliable income. A flat fee, for example, offers predictable revenue, and your client knows how to budget for legal services. A subscription model provides similar predictability and provides reliable monthly income.

Payment collection also varies among the pricing models. An upfront flat fee or subscription payment provides revenue before the case starts and means less chasing after clients for payments. Also, consider your competitors’ pricing models. A competitor offering flat fee immigration services may be more attractive to clients than your hourly rate.

You don’t have to mimic your competitors’ pricing models, but be willing to accept the disadvantages your pricing model brings.

How To Determine The Correct Rates

Your law firm’s rates must allow your firm to turn a profit after costs. There are several pricing strategies your law firm might use:

- The cost-first strategy emphasizes recouping the firm’s expenses and turning a profit. You determine the desired profit margin, estimate your firm’s costs, and set your pricing.

- The competition-first strategy sets pricing based on your competitors’ fees. Your firm might set rates lower than your competitors or set rates and create services that provide greater value than your competitors offer.

- A value-first strategy sets rates based on the value you provide your clients. This strategy flips the traditional model of pricing services based on your time, effort, and skill. It sets pricing based on the client’s perceived value of the results or services you provide.

You’ll want to research your pricing options further before settling on your law firm’s pricing structure. Whatever rates you set, clearly communicate them to your clients. A pricing structure that is easy to comprehend improves the client experience and facilitates a stress-free billing system.

Ethical Considerations

Legal billing should be straightforward and comply with the American Bar Association’s (ABA) rules for professional conduct and IOLTA – Interest on Lawyers’ Trust Accounts. If you rely on payment software to deposit payments to your trust account, it must comply with IOLTA.

According to these rules, in general, law firms should:

- Charge reasonable fees

- Clearly communicate those fees to clients

- Accurately track billable hours

- Avoid double billing

- Promote fair and transparent billing practices

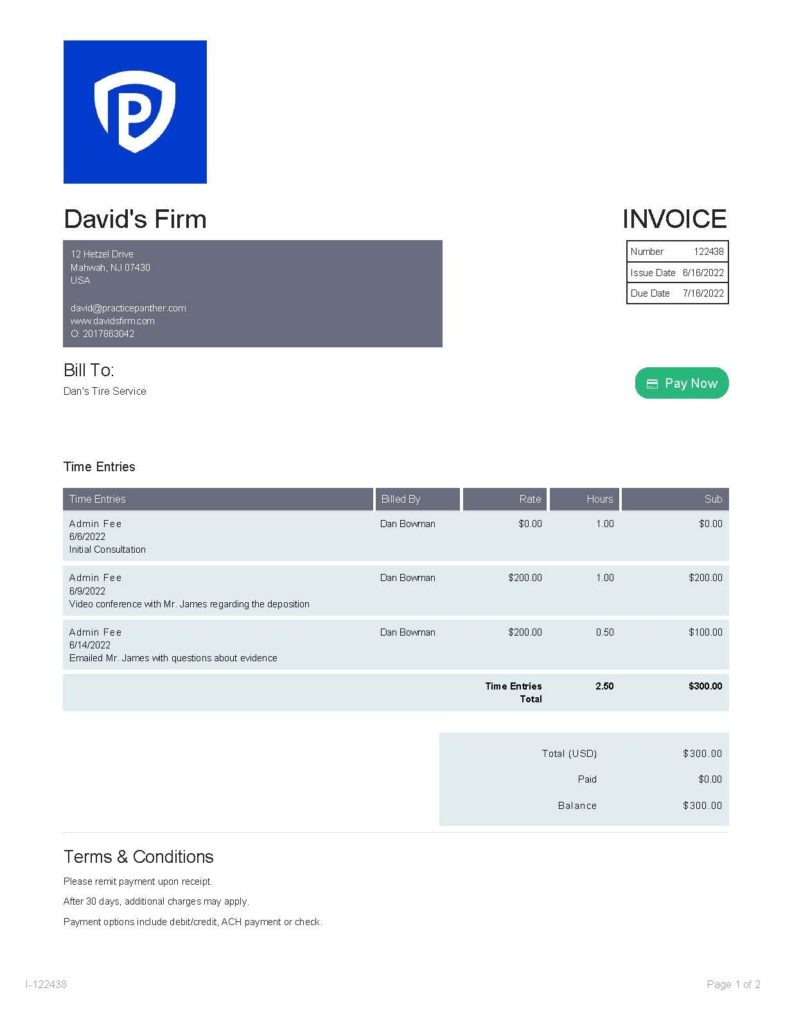

Legal Billing Examples

Whatever pricing model you choose, your law firm’s invoices and billing process should be clear. Ambiguous language, unclear payment instructions, and arbitrary guidelines portray your firm as disorganized and inconsistent. Your staff may spend more time fielding questions from clients or chasing payments if your billing invoices are confusing.

Your invoices should include your logo, address, and email address clients can use to contact you with their questions and concerns. Include an invoice number, the date, the client’s name and address, and the service period the invoice covers.

With PracticePanther, you can brand your invoices and create templates for different case types and billing models – e.g., an invoice template for family law and one for estate planning, or an invoice template for hourly billing and one for flat fees.

The following invoice features these crucial fields:

The invoice itemizes billable hours with clear descriptions and defines the timeline and options to submit payment.

Practice management software like PracticePanther allows you to add a payment link to your invoices so clients can pay directly from the invoice, streamlining the process for you and your client.

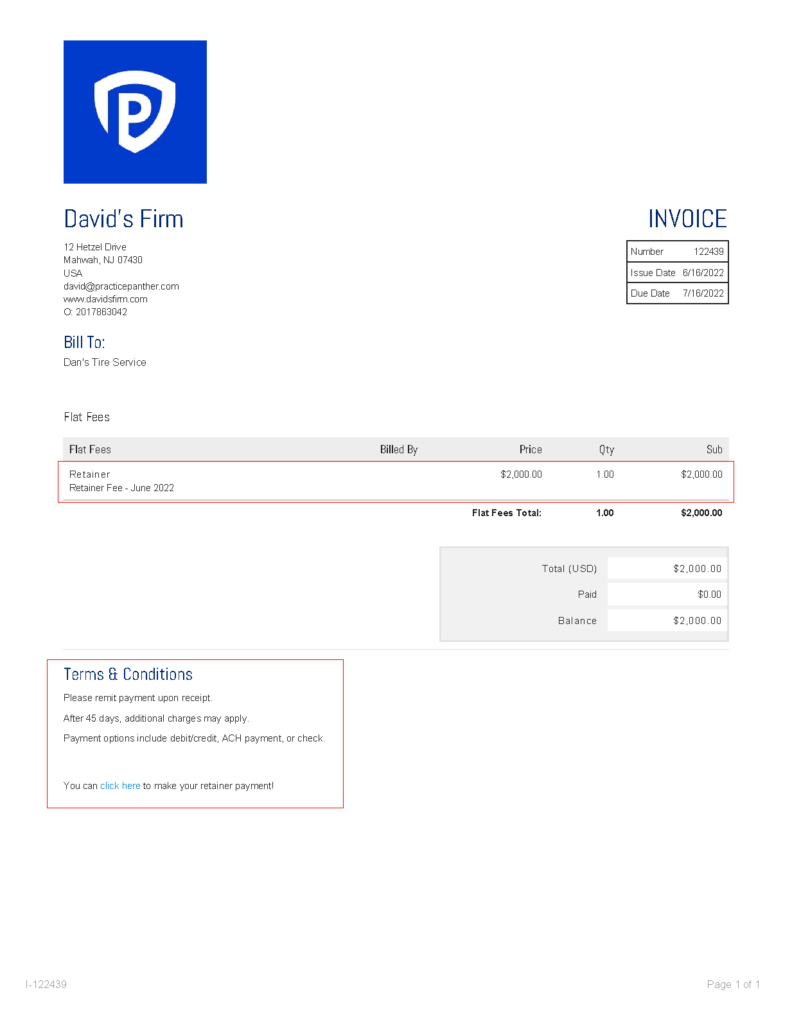

The next invoice reflects a retainer fee. It’s similarly descriptive in defining the billable item as a retainer fee for one month.

If you work on retainer, you’ll also have to report your hours, how they apply against the retainer, and how much of the retainer is left at the end of the billing period.

What To Include In Legal Billing Guidelines

Use straightforward language in your legal billing guidelines so your entire staff is operating from the same playbook and to prevent back and forth with clients. You’ll save time and money.

Below are key elements to include in legal billing guidelines:

Billing Process

Outline the billing process from start to finish. Include:

- Step-by-step flow of your billing process

- Who performs each step in the billing process

- Who approves invoice and how to request approval

- How to send invoices to clients

- When to send invoices to clients

Your guidelines should clearly establish every step in the process so there’s no confusion and everybody is following the same procedures so invoices go out on time and in the proper format.

Invoicing Procedures

Your invoicing guidelines should instruct your team on how to create invoices and bill clients. In particular, define:

- How to fill out the invoice

- How to write descriptions of your services

- Expenses to include on invoices

- Accepted payment methods (e.g,. electronically, via mail, in person, etc.)

Again, define who reviews invoices, how to request invoice approval, and how and when to send invoices.

As you outline your billing guidelines, find ways to simplify or automate steps. PracticePanther lets you create templates and automate sending invoices to simplify your billing procedures.

Deadlines & Late Payments

Guidelines on payment timing are essential to controlling cash flow. The longer it takes to receive a payment, the greater the strain on your business.

Encourage timely payments by setting deadlines and defining penalties for late payments. Your guidelines should establish:

- Deadlines to pay the bill (e.g., payable after 30 days or 60 days)

- How and when you will follow up with clients who fail to pay

- Penalties or fees for late payments

PracticePanther lets you add a Pay Now button to your invoice to make payments easier and get paid faster.

If your client doesn’t pay on time, establish a process for sending a friendly reminder. In the event they still don’t pay or refuse to pay, outline the consequences and next steps to resolve the issue.

Client-Facing Billing Guidelines

Share your billing guidelines with clients too. Your client-facing guidelines should explain:

- How your billing model works

- Payment structures you offer

- How and when they will get invoices

- How to make payments and accepted payment methods

- Penalties for late payment and consequences for failure to pay

You can use practice management software like PracticePanther to collect your clients’ e-signatures on your billing guidelines to confirm they received and agree to your policies. Allowing e-signatures instead of the traditional hand-written signature helps accelerate workflow.

Best Legal Billing Systems

Your firm’s legal billing systems should save you time and money, giving you peace of mind that you’re in compliance with all financial regulations. The best legal billing systems automates repetitive tasks like invoicing, simplify time-tracking, and comply with IOLTA, ABA, and state bar rules.

Not all software stacks up. Here’s what to look out for when purchasing legal billing systems for your law office.

What Solo Practitioners Should Look For

Running a solo practice can be challenging without the right technical resources.

Prioritize a legal billing software that saves you time that you can spend on billable hours and growing your client base. Solo practitioners should look for software with automated invoicing, especially software like PracticePanther that enables “batch” invoicing where you can populate hundreds of invoices with a single click.

You’ll also want a time-tracking feature to log in billable hours as you work. If you wait until the end of the week, you might fail to account for all the time you spent on a case and leave billable hours on the table.

What Small Or Mid-Sized Firms Should Look For

As a small or medium-sized law firm, your client base and workload are expanding.

Find a legal billing platform that enables your firm to cut manual processes, simplify payments, and gain insights into profitable practice areas so you can allocate more time and resources to them. Also, prioritize features that simplify time and expense tracking for your growing staff and allow you to streamline client invoicing with automated payment reminders and client-specific payment plans.

What Large Firms Should Look For

As a large law firm, your legal billing platform should simplify processes, automate tasks, and provide customized access to privileged financial information. Your staff can then access the financial insights and reports they need.

By streamlining your processes with software that allows large-volume payments and invoicing, multiple invoice templates for different case types, and a variety of billing models, your team can operate from the same playbook.

No matter your firm’s size, PracticePanther’s cloud-based platform and native billing features provide the security, financial insight, and accessibility your team needs from anywhere. It allows you to cut time and costs with automated workflows that trigger specific billing tasks, customized invoices that can be saved for repeated use, and process online payments that get you paid faster while offering white-glove service to your clients.

How To Set Up Billing At Your Law Firm

A concise billing strategy saves you time and money. These tips can help you set up billing in your law firm:

Set Up Invoice Templates

If your firm represents clients across several practice areas or offers different billing models, you can create invoice templates for them.

Here are some examples of templates you can create:

- A flat-fee invoice for a simple will

- A flat-fee invoice for an uncontested divorce,

- An hourly rate for a contested divorce or child custody case

Every invoice should include:

- Your logo

- Your firm’s name and address

- Client’s name and address

- Date

- Billing period

- Itemized breakdown of work completed

- Payment options (or a link to submit payment)

- Billing contact information

Remember, your invoice is a reflection of your firm’s brand. Each invoice should convey your brand’s professionalism and transparency.

Manage Billing Workflows

It’s no secret that billing processes are a constant frustration for many law firms. To prevent inefficiencies, create a billing workflow that everyone at your firm follows.

Here are some tips to help you manage your billing workflow:

- Document your current process — Write out (or ask an employee to write out) your current billing process.

- Identify and fix pressure points — Review the workflow for inefficiencies, redundancies, or missing steps. Then, draft your firm’s optimal billing workflow.

- Use the right tools — Use a customizable billing program like PracticePanther to create workflows that automatically assign tasks to your staff.

- Designate a billing manager — Hire or assign an employee responsible for overseeing or executing the billing workflow.

Communicate Your Billing Policy Clearly

Clear billing policies prevent confusion and frustration when it’s time for clients to pay their bills. Transparent billing fosters trust, too.

So, when you’re sitting down with clients to talk about your billing policy, here are a few points you should always cover:

- Invoicing timelines and frequency

- Available payment methods

- The client’s payment timeline

- Fees for late payments

Try to anticipate and clarify potential problems. Set up your terms to avoid errors, and make sure clients walk away feeling confident that they understand your policies.

What Is LEDES Billing?

The Legal Electronic Data Exchange Standard (LEDES) is a legal billing system established in 1995. Its goal was to simplify billing by creating a standard invoicing format.

Why Do Some Lawyers Bill In LEDES?

Insurance companies and other large corporations work with thousands of law firms. Imagine if all those law firms sent the insurance company invoices in different formats.

LEDES standardizes the format law firms use when sending invoices, simplifying the process and saving everybody time and money. Personal injury firms, workers’ compensation firms, and other firms that regularly work with insurance companies use LEDES.

Bonus: the standardized LEDES format makes compiling and analyzing data easy.

How To Bill In LEDES Format

The LEDES system uses task codes to itemize billing.

These are examples of legal billing codes you’ll use within the LEDES system:

● Written discovery

● Depositions

● Research

● Court fees

● Subpoena fees

● Deposition transcripts

LEDES files are text-based files. And they aren’t pretty:

INVOICE_DATE|INVOICE_NUMBER|CLIENT_ID|LAW_FIRM_MATTER_ID|INVOICE_TOTAL|BILLING_START_DATE|BILLING_END_DATE|INVOICE_DESCRIPTION|LINE_ITEM_NUMBER|EXP/FEE/INV_ADJ_TYPE|LINE_ITEM_NUMBER_OF_UNITS|LINE_ITEM_ADJUSTMENT_AMOUNT|LINE_ITEM_TOTAL|LINE_ITEM_DATE|LINE_ITEM_TASK_CODE|LINE_ITEM_EXPENSE_CODE|LINE_ITEM_ACTIVITY_CODE|TIMEKEEPER_ID|LINE_ITEM_DESCRIPTION|LAW_FIRM_ID|LINE_ITEM_UNIT_COST|TIMEKEEPER_NAME|TIMEKEEPER_CLASSIFICATION|CLIENT_MATTER_ID[]

Billing software like PracticePanther simplifies LEDES billing by requiring specific fields and providing the proper task codes. When you’re done, just click to download as a LEDES file that you can send or upload as needed.

What Are The Advantages Of LEDES Billing?

LEDES offers several advantages:

- Every LEDES file contains the same fields and task codes so the data is clear.

- The standardized format makes it easy to search and analyze data so you always know your firm’s financial health.

- It saves you time by taking the guesswork out of itemizing tasks and billable hours.

How To Manage Law Firm Accounting

Precise law firm accounting maximizes profits and maintains healthy cash flow. Keeping accurate records allows you to file taxes and make financial decisions with confidence.

The Difference Between Trust and Operating Accounts

You have to keep your firm’s funds separate from funds you’re holding for clients. Fail to do so and your firm could be in big trouble.

Payments for services rendered go into the operating account. You can use the account for rent and payroll, to pay debts, and for general operating expenses.

Settlement funds you collect for clients go to your trust account. Retainer and subscription payments go to your operating account too; you can transfer fees to your operating account as you bill for services.

Essentially, funds in your trust account are not yours. Keeping these funds separate and complying with the rules governing trust accounts stresses a lot of lawyers.

How To Avoid An Audit

Do you know a lawyer who found themselves in hot water because they didn’t have their trust accounting in order? Fail to keep earned and unearned funds separate and you could face severe penalties. If you receive retainer payments, settlement funds, or otherwise hold funds for your clients, your accounting needs to reflect compliance with financial regulations for trust accounts.

How can you keep your accounting in order and avoid painful audits? Your practice management software should allow you to receive funds in both your operating and trust accounts and keep tidy records of funds received.

How To Choose The Right Accounting Software

Choose software that complies with IOLTA (Interest on Lawyers’ Trust Accounts), the ABA’s rules of professional conduct, and your state bar association’s ethical rules.

Your accounting software should make time-tracking, billing, and record-keeping easy with features like:

- Expense and time tracking as you work

- Automated payment requests

- Customizable invoice templates

- Ability to receive funds in trust and operating accounts

- LEDES-compliant invoicing

- Powerful filters to analyze your firm’s finances

How To Get Your Law Firm Paid Faster

Delinquent invoices can lead to costly delays, missed payments, and fines.

Here are some tips to help your law firm get paid faster.

The Importance Of Accurate Timekeeping

A comprehensive record of a client’s billable hours reinforces trust and transparency. Payment processes are always quicker when records are detailed and straightforward. Not to mention, a meticulous timekeeping record creates a paper trail you can depend on in case of discrepancies or questions.

Failing to account for even a few minutes every day can lead to lost billable hours. Furthermore, client payments are delayed while you’re trying to account for those hours.

Skip the stress of tracking how many hours you spent researching, writing, and working on a case. Instead, invest in billing software that incorporates timekeeping. This feature makes it easy to determine what you’re owed and allows you to send invoices to clients quickly.

Why Sending Reminders To Clients Is A Priority

In a perfect world, no one would have to send payment reminders. Unfortunately, chasing payments is the reality for many law firms. Sending payment reminders and informing clients about the consequences of a late payment is uncomfortable, but it can make all the difference in how fast you get paid.

So, to help ease the awkwardness, keep a friendly tone in your message. Avoid language that sounds like you’re warning them about their upcoming payment, but rather, that you’re reminding them.

Reminders are most effective in advance of the payment’s due date. For example, you can program the reminder to send one week before the payment is due, then three days, the day before, or the day of the due date to ensure you receive your payment on time.

How To Automate The Law Firm Payment Process

Some law firms lack the internal processes to handle payments effectively, which delays payments and can strangle a law firm’s finances.

Thankfully, there are ways to streamline payments, helping your firm’s billing department stay on top of pending invoices. Here are some ways to automate your payment process for quicker payments:

- Use simple law firm billing software

- Consider faster payment methods like electronic money transfers

- Set convenient payment schedules for clients

- Automate the collection process by setting alerts for received or late payments, payment schedules, and client feedback

- Provide your clients with an embedded link so you can get paid via credit card or eCheck

How To Accept Online Payments

If you’re ready to make significant improvements in your billing process, accepting online payments is a great place to start.

Why Online Payments Are More Efficient Than Traditional Billing

Compared to traditional billing, online payments are typically easy and secure. When your firm uses this payment method, you eliminate the risk of lost or bounced checks.

Online payments are significantly faster too. In traditional billing, sending invoices and drawing checks can take months. With online billing, your clients can receive, review, and pay invoices on the same day.

PracticePanther lets you add a payment link to your invoices so your clients can pay right from the invoice.

How To Set Up Online Payments

Setting up an online payment system for your law firm is easier than you think.

- Select e-payment processing software that integrates into your legal billing.

- Review the online payments system with your team to ensure everyone understands it.

- After enabling online payments, update your legal billing guidelines and share them with your clients.

- Ask clients about their preferred payment method, then adjust your billing records.

How To Accept Credit Cards

Setting up a credit card payment process doesn’t have to be complicated. These tips can help the process run smoothly:

- Determine the best credit card payment process—physical and online.

- Find a payment processor. Ensure your credit card processing provider offers credit card solutions for trust and operation accounts.

- Set up your credit card processing software.

- Notify your clients of this change.

How To Accept ACH Payments

Automated Clearing House (ACH) payments are electronic or digital payments.

Here are a few pointers on how to start accepting ACH payments in your law firm:

- Check that you have target clients who prefer ACH payments.

- Choose an ACH provider familiar with law firm payment processing.

- Incorporate an ACH payment set up in your billing software.

- Update your clients and include ACH payment instructions on your invoice.

Automate Your Legal Billing With PracticePanther

By following these guidelines, you will be well on your way to meeting the challenges that legal billing presents, and freeing up your time to do what you do best: Serving your clients’ legal needs.

Request a free demo of our software today to see how PracticePanther can simplify your legal billing and automate your law firm so you can get more done in less time.